Atilẹba idana & Bath Kitchen & Awọn akọle wẹ

Laipe, FBHS announced that it has completed the acquisition of Aqualisa Holdings (hereinafter referred to as Aqualisa) for $160 milionu (nipa RMB 1.080 bilionu). FBHS owns well-known bathroom brands such as Moen and ROHL. In the first half of the year, its water innovation business had sales of $1.294 bilionu (nipa RMB 8.728 bilionu). The acquisition will strengthen FBHS’s global presence in the sanitary industry.

Spending about 1.08 billion yuan to acquire a British bathroom company

On August 1, local time, FBHS announced that it has acquired Aqualisa, a British bathroom brand known for its innovative and intelligent shower systems and customer service. The acquisition was completed on July 29 for approximately $160 milionu (to RMB 1.080 bilionu).

Nicholas Fink, CEO of FBHS, said the acquisition is a key strategy for the company in the water sector. As a member of the Water Innovation business, Aqualisa will enable the company to provide strong momentum in water management, connected products and global sustainability. Also, with the Aqualisa acquisition, FBHS’ Water Innovation business will gain access to digital shower products across price points, technologies and regions, driving further business growth.

Nicholas Fink also said that Aqualisa is a great addition to the company’s bathroom brands such as Moen and ROHL. They will leverage strong marketing capabilities and a continuously growing water innovation platform to expand sales in the U.S., U.K. and Europe, and enter new markets in the future.

According to public information, Aqualisa was founded in 1976 and is a leading manufacturer of intelligent shower products. It has a strong reputation in the UK market for shower products manufactured and marketed primarily under the Aqualisa brand. Lọwọlọwọ, the company is headquartered in Westram, UK, and employs about 260 eniyan. As previously reported, Aqualisa replaced its chief executive officer not long ago. Mat Norris has replaced Colin Sykes, who had held the position since 2018. The latter will continue to serve as a non-executive director and strategic advisor to the company.

First-half sales of approximately $27.183 bilionu

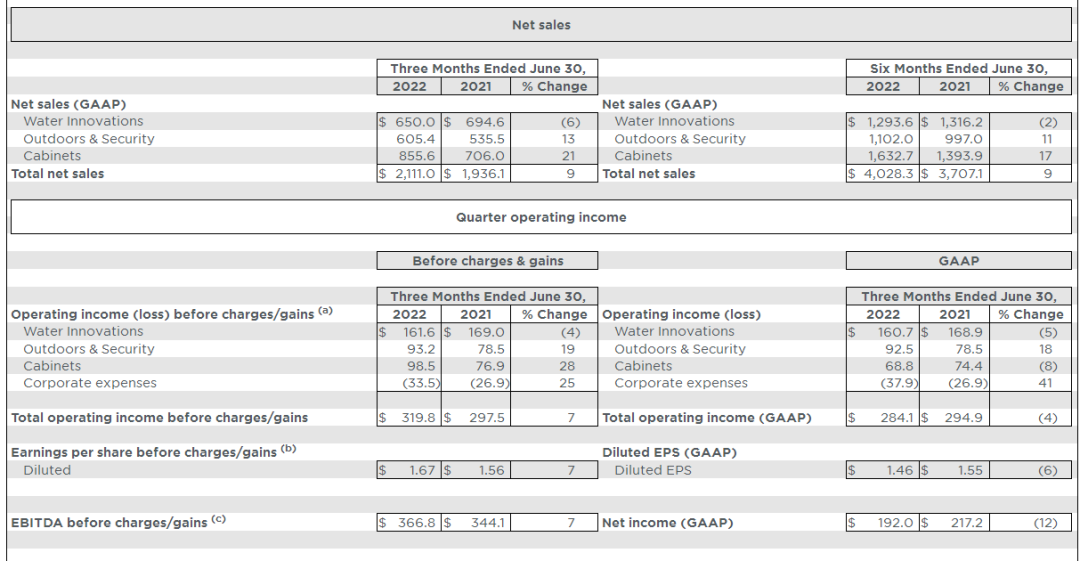

According to the recently released FBHS H1 2022 report, the company achieved sales of $4.028 bilionu (to RMB 27.183 bilionu) lati January to Okudu, ilosoke ti 9% odun-lori-odun. During the same period, FBHS’ EBITDA was $373 milionu, a 6% decrease year-over-year.

By business, in the first half of the year, sales of FBHS’ water innovation business (plumbing business) were $1.294 bilionu (to RMB 8.728 bilionu), a decrease of 2% odun-lori-odun. Sales of the cabinet business, including bathroom cabinets, were $1.633 bilionu (to RMB 11.014 bilionu), ilosoke ti 11% odun-lori-odun. Sales of outdoor and security products business were $1.102 bilionu (nipa RMB 7.432 bilionu), ilosoke ti 17% odun-lori-odun.

In its semi-annual report, FBHS mentioned price adjustment measures, saying that it delivered strong results in the second quarter as inflation was fully offset by price and cost-related measures. They also said that sales of outdoor and safety products and cabinet products all grew, driven by these measures. Sibẹsibẹ, sales in the Water Innovations business declined 6 percent in the second quarter due to the impact of the outbreak-related shutdown in China, and when China is removed, Water Innovations sales had a 4 percent growth rate and an operating margin of approximately 24.9 ogorun.

A review of FBHS’s annual reports published since its IPO shows that the company’s sales have doubled in 10 odun. Ninu 2011, FBHS sales were $3.3 bilionu, and have largely maintained a growth trend over the past 10 years since then. Nipasẹ 2021, FBHS sales reached $7.7 bilionu, ilosoke ti 26% from the previous year. Looking ahead to 2022, FBHS expects full-year sales growth to remain in the 6.5% si 7.5% range. Earnings per share are in the range of $6.36 si $6.50.

Acquired more than 20 awọn ile-iṣẹ ni 50 odun

Bi ile-iṣẹ nla kan, although FBHS is not as well known in China as subsidiaries such as Moen and ROHL, the development of this company is a typical example of the growth of the home industry through acquisition. O le sọ pe itan-akọọlẹ FBHS jẹ itan-akọọlẹ ti awọn ohun-ini ami iyasọtọ.

Ninu 1970, the company acquired Master Lock, a security lock company.

Ninu 1988, the acquisition of Aristokraft and Waterloo

Ninu 1990, the acquisition of Moen

Ninu 1998, acquired Decora, Diamond, Kemper, Schrock

Ninu 2002, acquired Omega

Ninu 2003, acquired American Lock, Therma-Tru doors

Ninu 2007, acquired Simonton windows, Fypon millwork products

Ninu 2011, listed on the New York Stock Exchange

Ninu 2013, acquired Wood Crafters

Ninu 2014, acquired Sentrysafe and sold Simonton windows

Ninu 2015, acquired Norcraft, sold Waterloo

Ninu 2016, acquired Riobel, Perrin & Rowe and established Global Plumbing Group (GPG)

Ninu 2017, the acquisition of Shaws, Victoria + Albert

Ninu 2018, the acquisition of Fiberon

Ninu 2020, the acquisition of Larson storm doors

Ninu 2022, the acquisition of Aqualisa

iVIGA Tẹ ni kia kia Factory Supplier

iVIGA Tẹ ni kia kia Factory Supplier