IBathroom Business School

Kutshanje, the global price of natural gas has seen a relatively large increase. The price of domestic natural gas exceeded 5,400 yuan per ton, a price increase of more than 100% over the same period of the previous year. Natural gas-rich U.S. prices also hit the highest level in nearly 10 years. Since this year, the price of raw materials rose sharply, combined with the current round of natural gas prices on the leap, the production costs of sanitary ware companies further increase. A new wave of product price increases or is already in the pipeline.

The price of domestic natural gas exceeded 5400 yuan/ton

According to CCTV reports, the recent global natural gas prices continue to climb. The price of natural gas in Asia has risen sixfold in the past year, and the European market has gone up tenfold in 14 iinyanga. On Aug. 22, the price of natural gas futures on the New York Stock Exchange reached $3.837 per million pounds, a new high in recent years.

Domestically, the National Bureau of Statistics released the “Market Price Monitoring of Important Production Materials in Circulation Nationwide in Early August 2021”, which showed that liquefied natural gas (LNG) rose by 10.2% YoY to reach 5,402.5 yuan per ton. It is reported that in 2020 the combined price of LNG is in the range of 2,500 yuan per ton. Kwi 2021, domestic LNG prices are driven higher due to the sharp increase in international LNG prices.

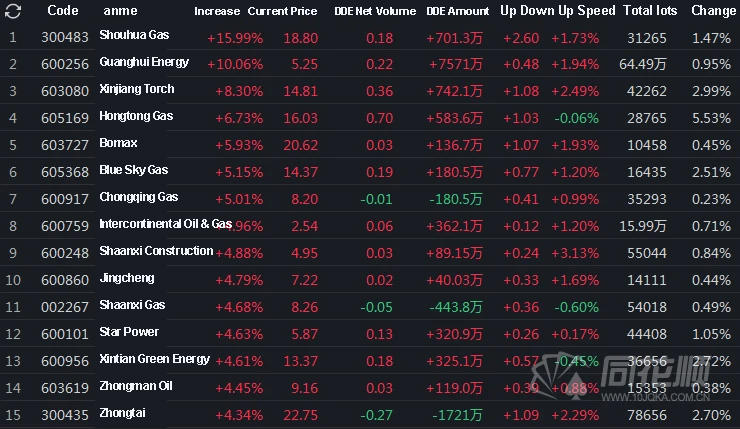

It is understood that the latest round of price increases for natural gas has been initiated since February 2021. Composite prices in the domestic market rose slowly from February and started to move significantly higher from the end of July. It even recorded 13 consecutive trading days of increases between July 29 and August 26. On August 23, 98 of the 113 natural gas concept stocks were rising, with Shouhua Gas up 20%, and many stocks such as Guanghui Energy, Blue Flame Holdings, GCL Energy, Shaanxi Construction, Xinjiang Torch, njl. were halted. By the end of the day, the overall price of the natural gas sector has risen 3.37% on the basis of the previous trading day.

It is reported that the global promotion of “ukungathathi hlangothi kwekhabhoni” is the main driving force behind the current round of natural gas price increases. The reason for this is that “Ikhabhoni engathathi hlangothi” has prompted manufacturing companies to “switch from medium to gas”. The entry of oil and gas companies into carbon-neutral LNG trading has also pushed LNG prices higher. Ukwengeza, the instability of renewable energy generation under extreme weather conditions may further push up natural gas consumption in the short term.

The natural gas price hike has spread to the ceramic sanitary industry

According to data released by the China Building and Sanitary Ceramics Association, as of 2020, the natural gas usage rate of building ceramic enterprises increased from less than 15% to about 55%. It is understood that at present, in Guangdong, Fujian, Shandong, Sichuan, Liaoning and other production areas, most enterprises have completed the clean energy transformation.

In the “incopho yekhabhoni” kwaye “Ikhabhoni engathathi hlangothi” strategic objectives, the major production areas kiln comprehensive rectification continued to promote. On May 26, the Guangdong Provincial Department of Ecology and Environment proposed that all the ceramic production lines under construction will use natural gas by July 1 this year. On June 2, Guangxi clearly pointed out that the ceramic production line in the Guangxi production area should be completed at the end of 2025 “coal to gas” transformation, otherwise eliminated. In August, Shanxi Shuozhou’s 15 pottery enterprises were named for not completing the “coal to gas” work. Shuozhou pointed out that if you can not complete the transformation of enterprises, you have to stop production and rectification. Kutshanje, Henan also issued a relevant program to strengthen the clean fuel alternative, to promote the coal-fueled boilers and industrial furnaces clean energy alternatives.

In the “incopho yekhabhoni” kwaye “Ikhabhoni engathathi hlangothi” trends, many enterprises have switched to natural gas on a large scale. According to the first half of the 2021 report of Huida Sanitary Ware, the company has one ceramic tunnel kiln, one shuttle kiln and 29 hot air furnaces, all of which use natural gas as fuel. There are 89 emission outlets for the process of flue gas emission, all of which use coke oven gas or natural gas as a clean fuel. In the first half of the year, the number of goods purchased and services received by Huida Sanitary to the associate Tangshan Jidong Natural Gas Gathering Co., Ltd. was 4,352,600 yuan, higher than the amount of 2,833,200 yuan incurred in the previous period. This reflects the increase in the cost of gas used in the current period.

Unit: million yuan

| Type of related transactions | Associated Person | Projected amount for 2021 | Actual incurred in the first half of 2021 |

| Purchase of goods and receipt of services | Tangshan Jidong Natural Gas Gathering and Transmission Co. | 1, 700. 00 | 435. 26 |

| Tangshan Hexiang Intelligent Technology Co. | 5, 500. 00 | 1,943. 95 | |

| Tangshan Fengnan Yijia Wood Industry Co. | 4, 200. 00 | 1,179. 68 | |

| Sale of goods and provision of services | Tangshan Fengnan Yijia Wood Industry Co. | 250. 00 | 83. 08 |

| Tangshan Bida Real Estate Development Co. | 200. 00 | 0. 00 | |

| Tangshan He Xiang Intelligent Technology Co. | 60. 00 | 3& 35 | |

| HUIDA SANITARY WARE(M)SDN. BHD | 2, 000. 00 | 105. 91 |

In the tile industry, Mona Lisa, a well-known domestic brand, has fully adopted natural gas in its three production bases in Xiqiao, Qingyuan and Guangxi to cope with the “incopho yekhabhoni”. Jiangxi production base is also in full swing of natural gas transformation. It can be expected that, with the large-scale use of natural gas as fuel for ceramic sanitary ware enterprises, the current round of price increases will have an increasing impact on these enterprises.

Many sanitary ware enterprises to start price increases

In addition to natural gas, the recent price of a variety of raw materials are into the upward channel, and so far continue to rise. According to the data released by the National Bureau of Statistics on August 9, 2021, in July the price of industrial production materials rose 12.0%, and the price of raw materials industry rose by 17.9%. Among the industrial producer purchase prices, the price of ferrous metal materials rose by 27.9%. Color metal materials and wire prices rose by 23.4%, and the price of chemical raw materials rose by 18.2%.

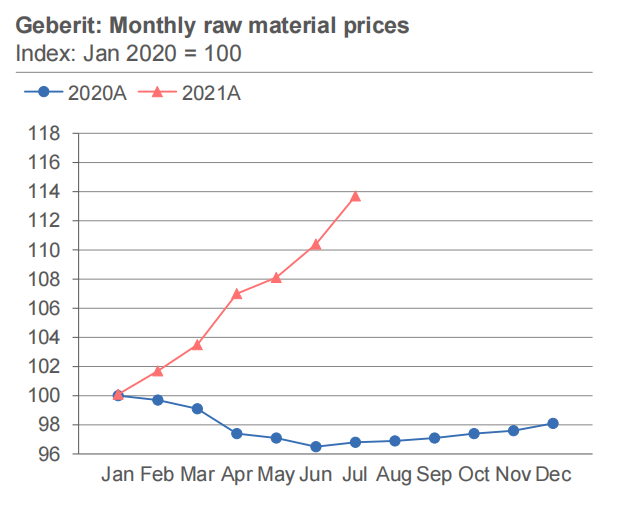

The current round of raw material price increases have obviously affected the bathroom industry, a number of companies have started the product price increases. Chenglin was in the first quarter and the second quarter for two waves of price increases. Gebreit revealed in its semi-annual report that one of the main reasons for the 46.1% increase in net profit in the first half of the year was the price increase of its products. The company also pointed out that the purchase price of raw materials has increased by 14% compared to the end of last year, and is expected to continue to rise by 6% in the third quarter of this year.

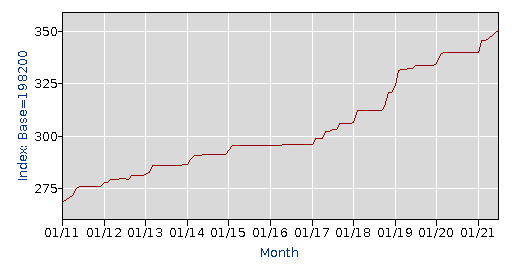

The macro consumer index published in some countries also reflects the higher prices of bathrooms and other building materials. According to data released by the U.S. Bureau of Labor Statistics (BLS), in the past July, the producer’s price index for bathroom equipment and accessories was 350.5, up 10.6 points over the same period last year. In early 2011, the U.S. bathroom equipment and accessories producer price index was only 268.6, an increase of 81.9 points in ten years.

In the face of a new wave of raw material price increases, companies can open source energy conservation in various production processes, lean production, lean management, cost reduction and efficiency improvements to reduce operating costs. It can also establish a linkage mechanism between the selling price of products and raw materials with upstream customers, or sign long-term cooperation agreements with raw material suppliers to minimize the impact of raw material extraction and its processing industry on the production and operation of enterprises.

iVIGA Tap Factory Supplier

iVIGA Tap Factory Supplier