Peito mo e falekaukau maʻuʻanga fakamatala ki he peito mo e falekaukau

According to the Kitchen Cabinet Manufacturers Association of America (KCMA) website, on November 3, 2022, ʻa e U. S. Department of Commerce notified Schagrin Associates of the final results of the first administrative review of the anti-dumping and countervailing case against wooden cabinets, bathroom cabinets and their components from China.

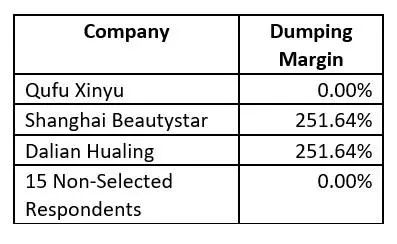

The first review period is from October 2019 ki Māʻasi 2021. Ko e U.S. Department of Commerce said there is no change from the preliminary results. According to the calculation, the dumping margin of mandatory respondent Qufu Xinyu ( Qufu Xinyu ) ʻOku 0. The dumping margin of mandatory respondent Shanghai Qifu ( Shanghai Beautystar ) ʻOku 251.64%. Voluntary respondent Dalian Hualing (Dalian Hualing) has a dumping margin of 251.64%. ʻIkai ngata ai, ʻa e 15 unselected respondent companies under review have a dumping margin of 0.

KCMA clearly states in the article that it will also significantly increase the anti-dumping duty rates of the 16 Chinese companies that now have zero duty rates.

Lolotonga, Chinese companies exporting cabinets, mo e alā meʻa pe. are still subject to the anti-dumping duty order. The current countervailing duty rate for companies not under review is 20.93%. Taking into account the 25% 301 tariff, a total of 45.93% of the total tariff is still payable.

iVIGA lomiʻi ʻi he fale ngaohiʻanga koloa

iVIGA lomiʻi ʻi he fale ngaohiʻanga koloa