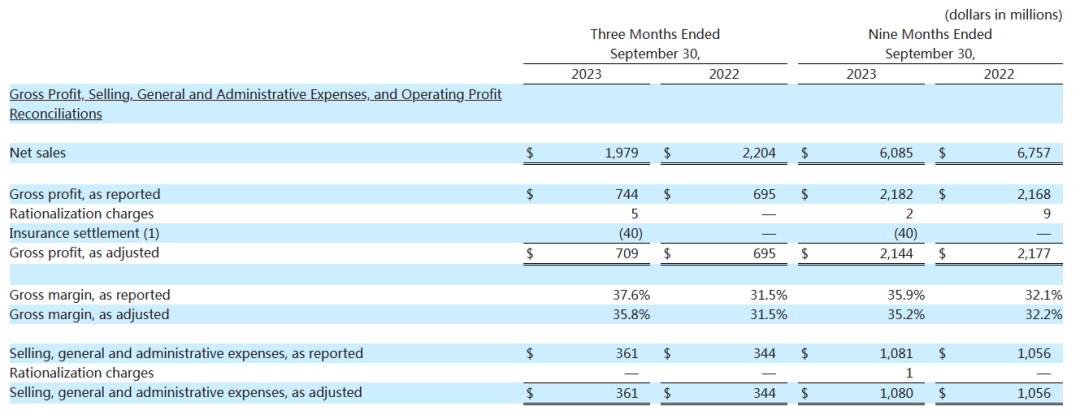

On October 26, MASCO, the parent company of Hansgrohe( well-know bathroom faucet supplier), released its third quarter report for 2023. The report shows that Musk’s sales in the first three quarters of 6.085 billion US dollars (Di 44.5 miliardi di yuan), una diminuzione di 672 million US dollars or 9.95% over the same period last year, of which the third quarter sales of 1.979 billion US dollars, una diminuzione di 225 million US dollars or 10%;

On the earnings front, net income attributable to the parent company was $717 million in the first three quarters, down from $729 million in the same period last year.

Despite the decline in both revenue and profit, Musk’s profit margin has steadily increased in the first three quarters, with its operating margin rising to 18.1% from 16.5% in the year-ago period.

Commenting on the results, Keith Allman, President and Chief Executive Officer of Musk, said the company’s continued ability to execute its strategy in a challenging market environment and the company’s continued focus on improving productivity resulted in strong margin performance and earnings per share growth in the third quarter.

He added that the company also returned $109 million to shareholders in the third quarter through dividends and share buybacks, and completed the bolt-on acquisition of Sauna360 Group Oy for approximately €124 million.

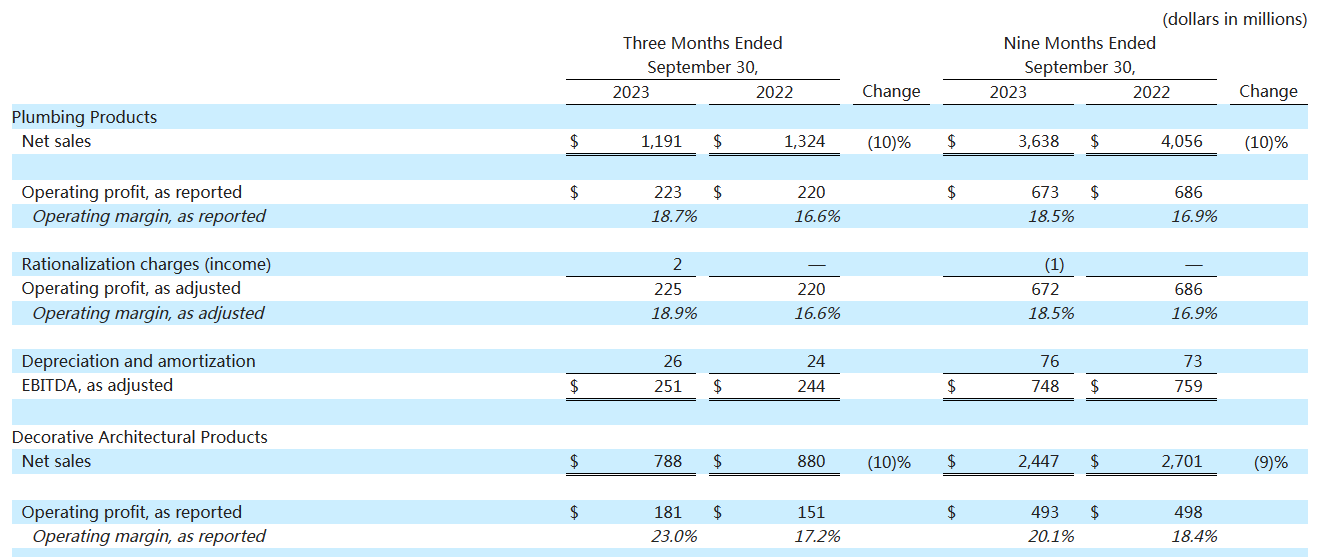

Water heating business sales of $3.638 miliardi

Accounting for nearly 60% delle vendite totali

The report shows that Masco’s main business is plumbing business and decorative materials business. The first three quarters of the water heating business sales of $3.638 miliardi, giù 10%, of which the third quarter of $1.191 miliardi, also down 10%;

Operating profit for the first three quarters was $673 milioni, down from $686 million a year earlier, but profit margins rose to 18.5%, up from 16.9% a year earlier.

Decorative materials business sales also declined in the same period, the first three quarters of $2.447 miliardi, giù 9% from the same period last year, operating profit of $493 milioni, slightly lower than the same period last year of $498 milioni, but operating margin reached 20.1%, up from 18.4% in the same period last year.

By region, North America is Musk’s largest market, with sales of $4.875 billion in the first three quarters, giù 10% from the same period last year, but still accounting for about 80% delle vendite totali. Il resto 20 percent of sales were accounted for by overseas markets at $1.21 miliardi, giù 9 percent from the previous year.

In the first three quarters, Musk took a series of steps to improve operations globally. Keith Allman said that the company’s price stability measures, product portfolio transformation, brand influence in the market and innovation ability have enabled the company to maintain steady growth throughout the cycle.

He said that in the long term, the fundamentals of the old reform market remain strong, which supports the company’s long-term growth.

Acquisition of sauna group Sauna360

In the first three quarters, new sub-brands were added

Masco is a giant in plumbing and decorative materials, con 38 brands, including Hansgrohe, AXOR, Delta, Ottone, Bristan and other bathroom brands, and decorative materials brands such as Behr.

In the first three quarters, one of the biggest moves of Masco was the acquisition of Sauna360, the sauna brand group, which holds a number of sauna brands such as Tylo, Helo, Kastor, Finnleo, Amerec, eccetera. under Masco, and the spa and health products business of Masco was further strengthened.

Looking ahead to the full year, Keith Allman said, “Given our strong operating performance, we expect 2023 adjusted earnings per share to be in the range of $3.65 A $3.75, up from our previous guidance of $3.50 to $3.65.”

While the demand environment for near-term repairs and alterations remains uncertain, we executed well and demonstrated the profitability of our business model. We remain committed to investing in brands and capabilities to drive strong growth and create long-term shareholder value when market conditions improve.”

Fornitore della fabbrica di rubinetti iVIGA

Fornitore della fabbrica di rubinetti iVIGA