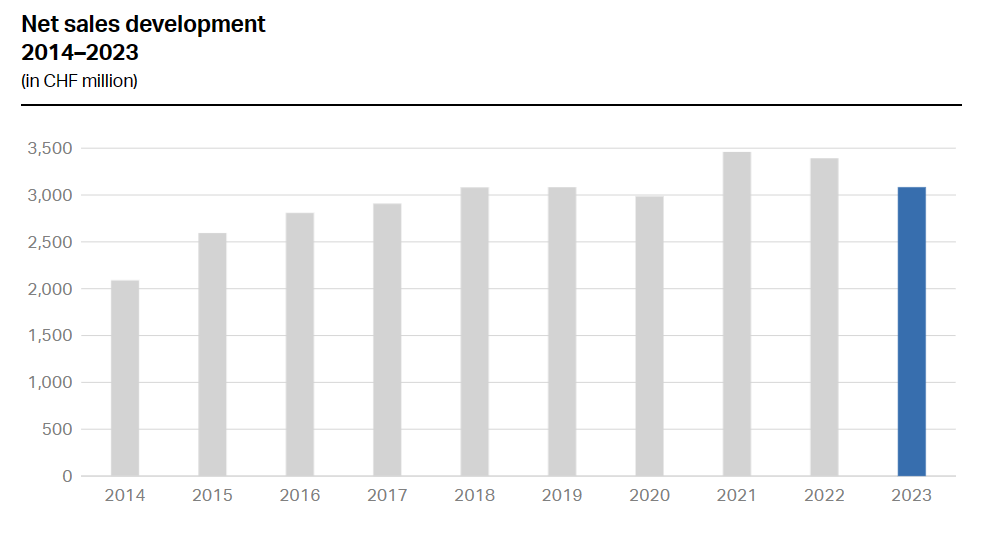

On March 13, Geberit released its 2023 annual report, which showed that annual sales decreased by 9.1% i 3.084 billion Swiss francs (ma kahi o RMB 25.218 piliona), of which sanitary products accounted for 30%; during the same period, EBITDA increased by 1.4%, hiki ana 921 million Swiss francs (ma kahi o RMB 7.531 piliona), and net profit was 617 million Swiss francs (ma kahi o RMB 5.045 piliona), a year-on-year decrease of 12.6%.

Geberit said that 2023 will be an extremely difficult year, and predicted that the prospects for 2024 will be mixed, predicting that market demand in China and Australia will decline.

Annual sales were approximately 25.2 piliona yuan, with the three major categories accounting for 30%.

According to the annual report released by Geberit, Geberit’s total sales in 2023 were 3.084 billion Swiss francs (ma kahi o RMB 25.218 piliona), a year-on-year decrease of 9.1%, mainly due to the negative currency effect of the Swiss franc, because the Swiss franc Much stronger than most other currencies

In local currency terms, this was a decrease of 4.8%. Geberit revealed that 63% of the group’s annual sales were settled in euros, 10% in Swiss francs, 7% in Nordic currencies (including Swedish krona, Danish krone, and Norwegian krone), 5% in U.S. dala, a 4% in British pounds. 11% is in other currencies.

Although last year’s average price increase of 8% for Geberit goods had a positive impact on sales, sales fell significantly due to the downturn in the European construction industry. Kahi mea hou aʻe, the shift in residential demand from sanitation to heating in some countries such as Germany has also negatively impacted the business.

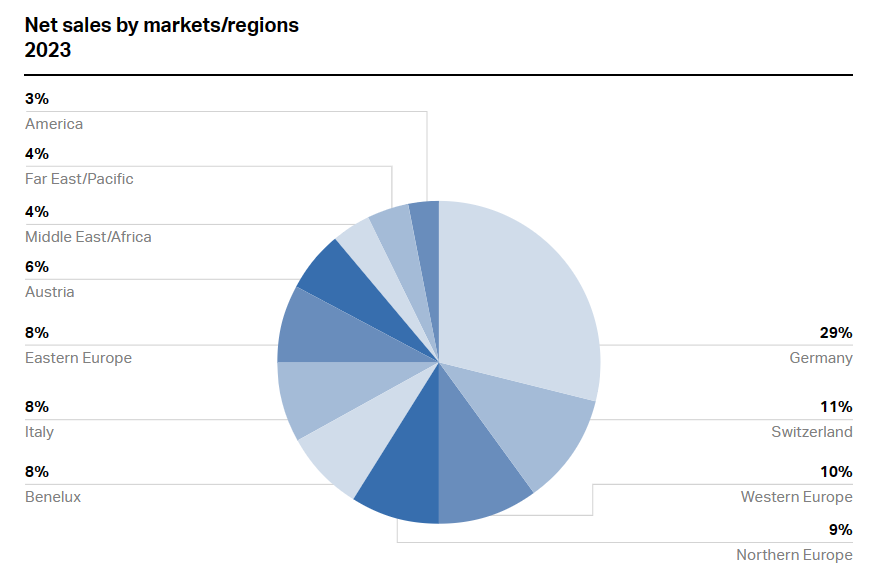

By market, the European market is most affected by the downturn in the construction industry. Overall currency-adjusted net sales in Europe declined 6.0%. Italy and Western Europe (UK/Ireland, Palani, Iberian Peninsula) experienced slight growth, with increases of 1.9% a 0.4% pakahi.

In comparison, the Benelux region (-1.9%), Switzerland (-4.0%), Northern Europe (-6.0%), Austria (-8.4%), Eastern Europe (-9.4%) and Germany (-10.5%) There was a decline, with the Far East/Pacific region also falling by 3.8%. In comparison, the Middle East/Africa and Americas regions grew by 17.1% a 1.5% pakahi.

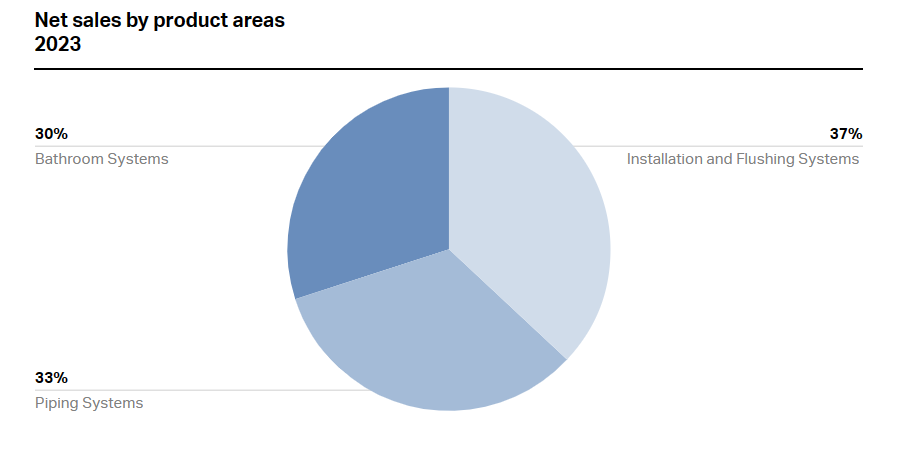

By product, sales of Geberit plumbing systems decreased by 2.2% i loko 2023, bathroom systems decreased by 5.7%, and installation and flushing systems decreased by 6.2%. The smaller decline in plumbing systems was due to the success of the new product Geberit FlowFit. The three major categories of products account for 30% or more of total sales.

Operating profit margin increased significantly, but net profit declined

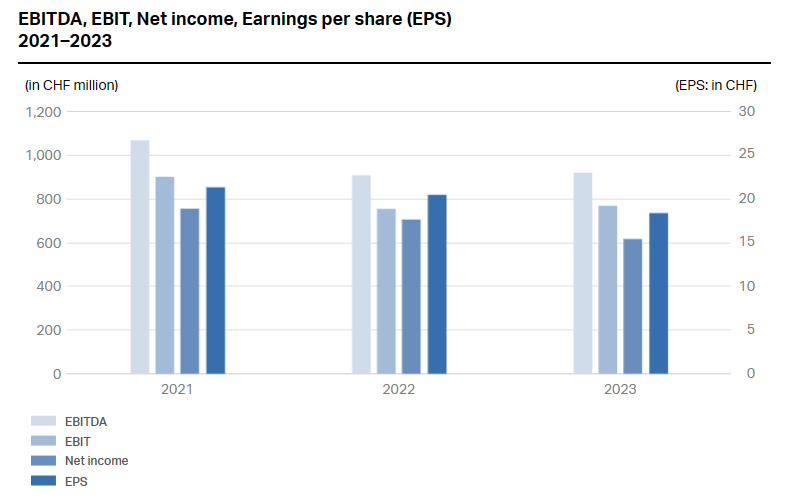

Ma ke ano o ka waiwai, Geberit’s EBITDA (earnings before interest, taxes, depreciation and amortization) increased by 1.4% i loko 2023, hiki ana 921 million Swiss francs (ma kahi o RMB 7.531 piliona), which is equivalent to an increase of 7.8% after adjusting for exchange rates; and Compared with the same period in 2022, EBITDA profit margin increased significantly by 310 basis points to 29.9%.

Operating profit (EBIT) increased by 1.8% i 769 million Swiss francs (ma kahi o RMB 6.288 piliona), with a currency-adjusted growth rate of 8.8%, and an operating profit margin of 24.9%, higher than 22.3% i loko 2022. Although the above data performed well, Geberit’s full-year net profit was 617 million Swiss francs (ma kahi o RMB 5.045 piliona), a year-on-year decrease of 12.6%.

In the financial report, Geberit mentioned that all projects last year were positively affected by currency effects. In particular, raw material costs have continued to decline since the first quarter of 2023, with average prices decreasing by 2.6% a i ʻole 25 million Swiss francs. This has resulted in raw material costs accounting for 25 million Swiss francs in sales. The proportion dropped to 28.8% from 31.7% last year.

In addition to lower raw material prices, Geberit’s labor expenses also decreased by 3.4% i loko 2023 to CHF 750 miliona, equivalent to 24.3% of net sales, compared with 22.9% i loko 2022, mainly due to the reduction in the number of employees.

As of December 31, 2023, Geberit had 26 production bases around the world, 4 of which were located outside Switzerland. The total number of employees worldwide was 10,947, a decrease of 567 people or 4.9% from the end of 2022, due to production and logistics-related businesses. Volume has declined, thus reducing the number of relevant employees.

2023 will be extremely difficult, 2024 will be a mixed bag

Geberit said in a press release accompanying the annual report that the company had experienced “an extremely difficult year” i loko 2023. The lower performance growth was due to the decline in the European construction industry and the previous year’s decline. year-on-year growth. Eia naʻe, the tension in global and regional supply chains has eased during this reporting year, the supply cost of raw materials and parts has dropped, delivery time has also been significantly shortened compared with 2022, and operating profit margin has increased significantly compared with the past.

For 2024 as a whole, Geberit’s judgment is roughly the same as the company’s statement in its financial express in January this year: due to challenging macroeconomic conditions and continued geopolitical risks, the construction industry is expected to decline overall this year. He ʻokoʻa, it is expected that the market demand for refurbished vehicles will continue to be strong, with sales from the refurbished market accounting for approximately 60% of Geberit’s total sales. Although Geberit’s overall forecast for 2024 is negative, it is expected that interest rates will be structurally lowered during the year and improved health standards will also stimulate the market. Outside of Europe, the outlook for the year is expected to be mixed, with strong demand in India, the Gulf and Egypt and declines in China and Australia.

Mea hoʻolako iVIGA Tap Factory

Mea hoʻolako iVIGA Tap Factory