In recent days, due to the influence of the Houthi armed forces in Yemen, the risk of international ships sailing in the Red Sea has increased. The world’s major container shipping companies have urgently announced the suspension of Red Sea routes through the Bab el-Mandeb Strait. Affected by this, shipments from Asia to the Middle East, North Africa, Europe and other places of goods are facing supply disruptions in the short term.

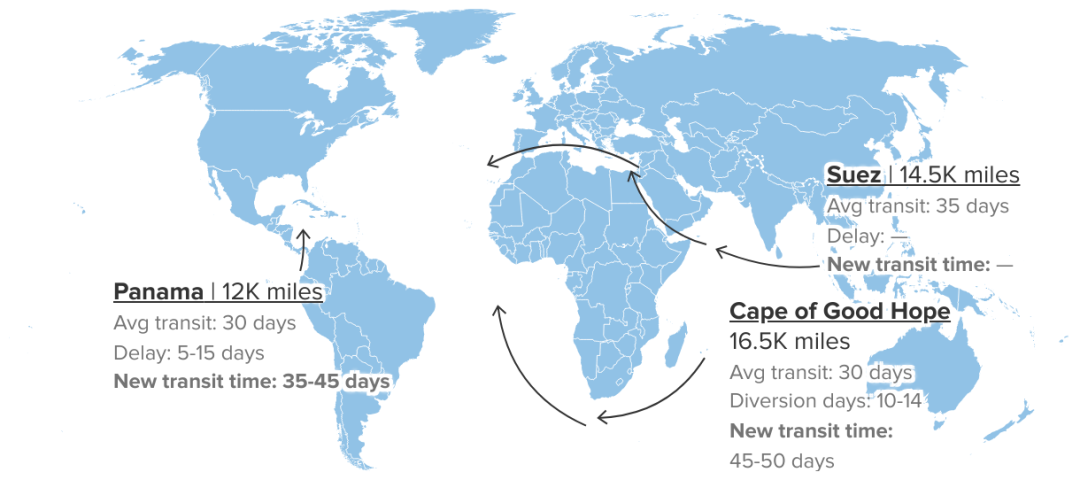

Ar hyn o bryd, some shipping companies have begun to avoid the Suez Canal and sail through the Cape of Good Hope in South Africa. Fodd bynnag, due to the increase in voyage distance and the extension of shipping time, shipping costs and freight rates have increased.

This price increase has also affected surrounding areas. Er enghraifft, freight rates for shipments to the Middle East and other places via the Persian Gulf have also increased to varying degrees.

Shipping companies suspended Red Sea routes, freight rates soared 40%-60%

Affected by the Houthi armed forces in Yemen, many shipping companies have recently announced the suspension of navigation in the Red Sea. Many shipping giants such as Mediterranean Shipping Company, CMA CGM, Maersk Group, and Hapag-Lloyd have suspended the navigation of their container ships in the Red Sea and adjacent waters. Yn ychwanegol, COSCO Shipping, Orient Overseas, Evergreen Shipping, and ONE Ocean Shipping have all verbally informed that they will suspend the pickup of cargo on the Red Sea route.

Affected by this, freight rates on the Asia-Europe route have risen sharply. Ocean liner operators and shipowners have already rerouted dozens of ships around the Cape of Good Hope, which will result in an additional 10-14 days of sailing time on routes from Asia to Northern Europe and the Eastern Mediterranean, and a 40%-60% increase in freight rates.

The price increase has also affected surrounding areas. According to data released by the Shanghai Shipping Exchange, on December 15, the market freight rates for exports from Shanghai Port to European and Mediterranean basic ports were US$1,029/TEU and US$1,569/TEU respectively, i fyny 11.2% a 13.1% respectively from the previous period. Freight charges to the Middle East and other places via the Persian Gulf have also increased to varying degrees.

Already home furnishing companies have warned: Ceramic related products are also affected

Home furnishing giant IKEA recently warned that some of its products may experience delivery delays due to the impact of the Houthi armed forces on the route from the Red Sea to the Suez Canal. IKEA said it is in dialogue with transportation providers and evaluating other supply route options to ensure its products can be delivered to customers. Many of the company’s products typically travel through the Red Sea and Suez Canal from factories in Asia to Europe and other markets.

In the ceramics industry, many countries in the Middle East are export destinations for Chinese products. Yn ychwanegol, many upstream companies export ceramic machine equipment, accessories, consumables, colored glazes and other products to the Middle East and North Africa.

According to multiple industry insiders, they have also been affected to a certain extent by this freight price increase, and exports to Saudi Arabia, Iraq, yr Aifft, Israel and other countries are facing delays and supply cuts. If the situation cannot be eased in the short term, sea freight rates may remain high as they were during the epidemic.

If the situation worsens, sea freight may increase by 100%

The Red Sea is located at the junction of the two continents, Asia and Africa. The route through the Bab el-Mandeb Strait, the Red Sea, and the Suez Canal is one of the busiest shipping routes in the world. According to the Neue Zürcher Zeitung, approximately 12% of global cargo transportation passes through the Red Sea and Suez Canal.

Currently, the top 10 container liner companies in the world in terms of shipping capacity have all announced the suspension of traffic on the Red Sea route or the suspension of accepting cargo bookings. Many oil companies and shipping companies in the United Kingdom, Almaen, Norwy, Belgium and other countries announced the suspension of transportation and navigation through the Red Sea.

The London insurance market has classified the southern waters of the Red Sea as a high-risk area. If merchant ships need to pass through this area, they must inform their insurers in advance and purchase additional war insurance. Analysts at Norwegian analytics agency Xeneta predict that ocean freight rates could rise by as much as 100% depending on the scale and duration of disruptions to the Suez Canal route.

If the situation in the Red Sea worsens further, the detour or suspension of ships will have a greater impact on the global supply chain.

iVIGA Cyflenwr Ffatri Tap

iVIGA Cyflenwr Ffatri Tap