קלאָזעט ביזנעס שולע

לעצטנס, research firm Titze released an analysis of the European bathroom furniture market. During the pandemic, the European market for bathroom furniture, cabinets and bathroom mirrors grew to 2.4 billion euros (18.34 ביליאָן רמב).

According to the report, during this 10-year period, traditional channels have been greatly affected due to the impact of e-commerce and traditional channels such as DIY stores, furniture and kitchen retailers. The report predicts that by 2025 the distribution channels of bathroom furniture, mirror cabinets and mirrors with lights in the European market will change dramatically.

During 2015-2020, the share of traditional offline bathroom retailers in Europe declined from 22.5% צו 21.2% (19.6% expected in 2025). DIY stores declined from 20.9% צו 18.8% (17% אין 2025), and kitchen furniture retailers declined from 33.4% צו 31.5% (28.8% אין 2025).

During this period, e-commerce sales in Europe rise from 11% market share in 2015 צו 16.4% אין 2020 and are expected to reach 22.8% דורך 2025.

In the UK market during the same period, the e-commerce channel becomes the main distribution channel in 2020 with a market share of 26.5%. This is followed by DIY stores with 24%, kitchen furniture retailers with 18.5% and bathroom retailers with 18%.

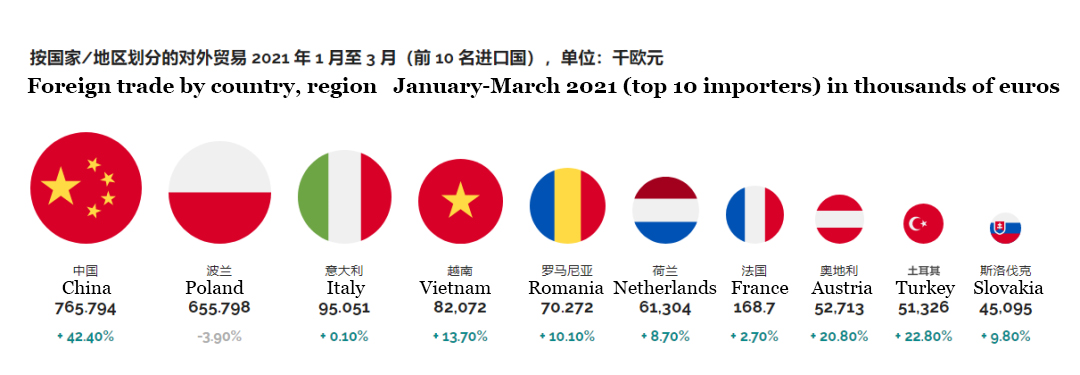

German furniture trade achieved a growth of 1.2% אין 2020. The share of offline retail declined slightly to 73.6%. The share of e-commerce expanded from 10.1% אין 2019 צו 11.5%. the share of imported furniture in Germany increased by 12.29% between January and March 2021. The top 5 most important import markets for furniture sold in Germany are China, followed by Poland, איטאליע, Vietnam and Romania. While imports from China continue to grow, imports from Poland, the main importer, are down.

The report forecasts that e-commerce market share will rise to 32.5% דורך 2025. Kitchen furniture retailers will fall to 17 פּראָצענט. Bathroom retailers will fall to 16.5 פּראָצענט.

From the surveyed suppliers in European countries, אַ גאַנץ פון 376 manufacturers, including Italy accounted for 20.4%, Germany accounted for 19.9%, the United Kingdom accounted for 10.6%. Based on the local market share of the top manufacturers in the 10 countries surveyed – דייטשלאנד, Austria, Switzerland, the Netherlands, Belgium, the UK, פֿראַנקרייַך, איטאליע, Spain and Poland.

Topping the list is Pelipal (€116 million), second Burgbad (€100 million), third Royo (€85), fourth Puris (£72 million), fifth Roca (€65 million) and sixth Villeroy and Boch (€48 million). The top 10 manufacturers with the highest turnover accounted for 37.6% of the market share.

iVIGA טאַפּ פאַבריק סאַפּלייער

iVIGA טאַפּ פאַבריק סאַפּלייער