Kök Och Bad. Kök Och Bad Rubriker.

Nyligen, Lixil Group, TILL TILL, Musk, Geberit, Takara Standard and other foreign companies have announced their half-year or quarterly reports. The reports show that during the epidemic, the sales and net profits of the companies have declined to varying degrees, and some companies have even made zero entries. The current epidemic in Spain, Tyskland, Storbritannien, Japan and other countries has been repeated, and the impact on companies is expected to continue.

Lixil Group.

Business Profit Slips 125.1% To Loss In April-June

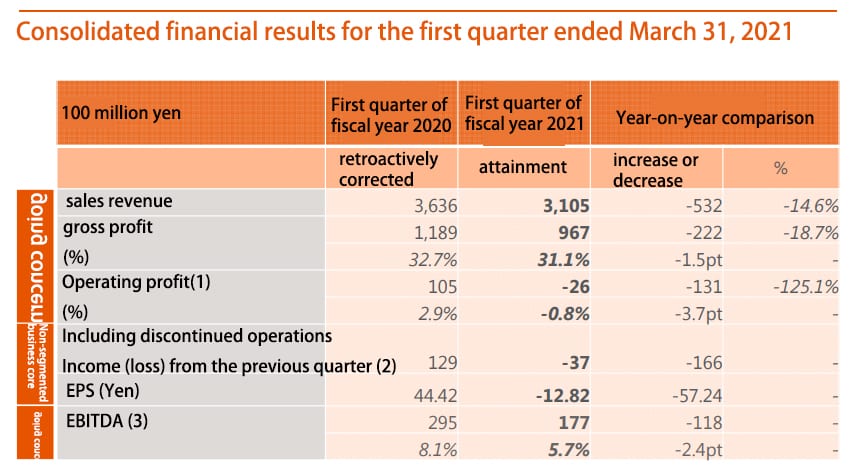

Den augusti 6, 2020, the Lixil Group announced its first quarterly report for fiscal year 2020 (april 2020 to March 2021), and from April to June 2020, a number of financial indicators declined due to the impact of the epidemic and the increase in the Japanese consumption tax. Bland dem, sales fell 14.6% till 310.5 billion yen (handla om 20.490 miljarder yuan), business profit fell 125.1% till -2.6 billion yen (compared with a profit of 10.5 billion yen a year earlier), and EBITDA narrowed to 17.7 billion yen from 29.5 billion yen in the same period a year earlier.

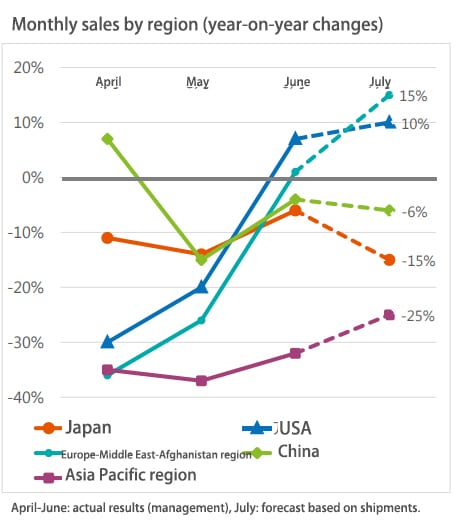

From April to June, shipments declined the most in China, down from nearly 10% positive growth in April to less than -10% in May, and then tended to recover, although a decline of about 6% is expected in July. Däremot, the U.S., EMEA markets bucked the trend, with the U.S. market jumping from negative growth of -30% in April to positive growth of nearly 10% in June.

The Lixil Group recorded sales declines in all major markets from April to June, with the largest declines in Asia Pacific (-31%), Europe and Central Africa (-20%), the United States (-15%), Japan (-11%) and China (-7%), resulting in a 99% decline in operating profit outside Japan and a 58% decline in operating profit in Japan, for a total decrease in operating profit of $0.5 miljard. 78% and operating profit margin was only 1.8%, en minskning av 5 points from the same period last year.

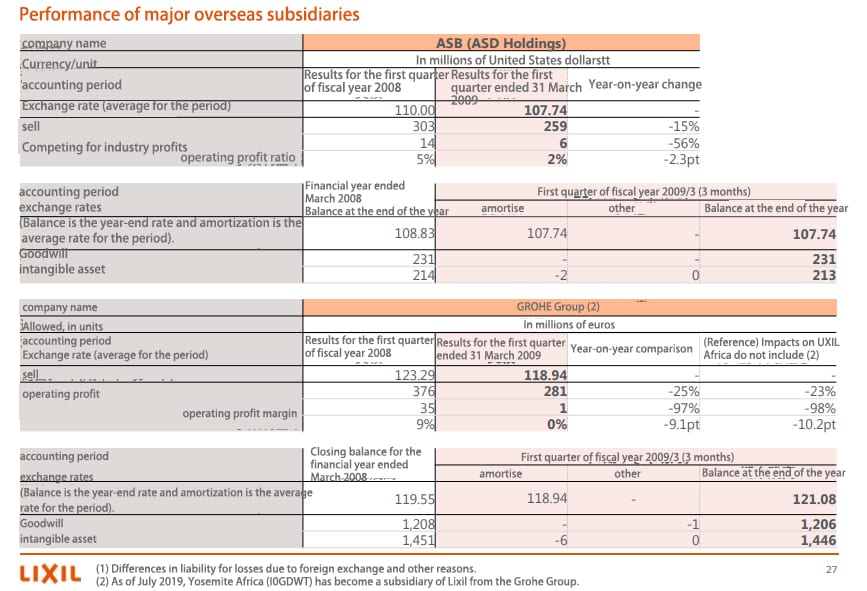

In terms of sub-brands, ASB (ASD Holdings), a subsidiary of American Standard, achieved sales of $259 miljon (about RMB 1.803 miljard) in April-June, ner 15% år på år, with operating profit of $60 miljon, ner 56% år på år, and profit margin down 2.3 points to 2%. GAO reported sales of 281 miljoner euro (about RMB 2.317 miljard) in April-June, ner 25% år på år, with an operating profit of 01 miljoner euro, ner 97% år på år, and a margin cut to 0%.

Musk.

Good Performance In The First Quarter To Offset The Impact Of The Outbreak In The Second Quarter

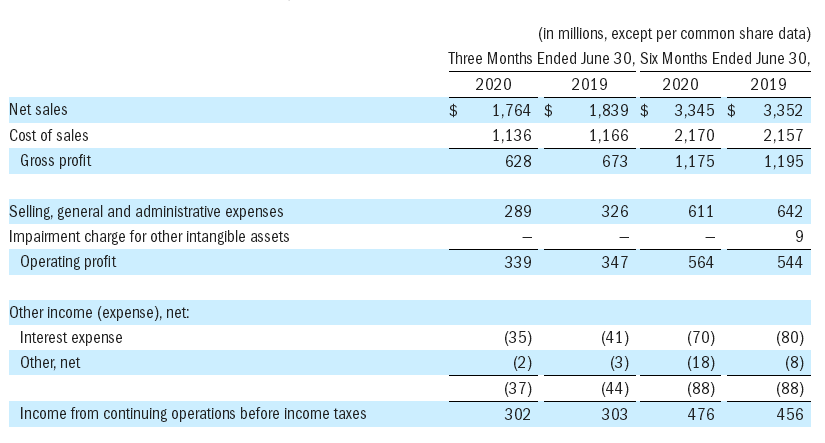

I juli 30, Musk Group reported the second quarter of 2020.In April-June 2020, Musk achieved sales of $1.764 miljard (about RMB 12.279 miljard), ner 4% år på år; operating profit of $339 miljon, ner 2% år på år; affected by the epidemic, Musk pipeline products sales from the first half of 2019 1,012 million to $868 miljon, en nedgång på 14%. dock, improved sales of coatings and related products drove an 8% increase in sales of decorative building products.

For the entire first half of the year, Musk’s sales were down just $07 million to $3.345 billion from $3.352 billion for the same period in 2019, and operating profit even increased by $20 million to $564 miljon, reflecting Musk’s good first quarter sales, which only declined in the second quarter due to the epidemic.

Musk CEO Keith Allman said the company puts the safety of its employees and customers at the forefront of its mind, and while there are many unknowns, strong demand for the company’s products is expected to continue in the third quarter, assuming there are no temporary shutdowns due to the outbreak.Allman also revealed that the board of directors has announced a 4 percent increase in the annual dividend to $0.5 billion per share beginning in the fourth quarter. 0.56 as a sign of confidence in the future.

Geberit.

First-Half Sales Down 10 Percent.

Asian Markets Down Over 24%

According to Geberit’s first-half report released on July 6, 2020, Januari-juni, Geberit achieved sales of CHF 1.468 miljard (about RMB 11.217 miljard), ner 9.8%, of which Europe and the United States decreased by 8.7% och 8.6% respektive, the Far East and the Pacific, the Middle East and Africa fell by as much as 24.2% och 31.6%. .

On a regional basis, after adjusting for currency exchange rates, Geberit’s first-half sales declined the most in the UK and Ireland (-34.1%), the Middle East and Africa (-25.9), Italien (-25.1%), the Iberian Peninsula (-20.9%), Frankrike (-19.2%), the Far East and Pacific (-18.5%) and the United States (-5.4%). Only Germany, Scandinavia, Schweiz, Eastern Europe, Benelux and Australia recorded sales growth, although in the German market, where growth was greatest, the increase was also only 2.9%.

On the product side, first-half sales in all three of Geberit’s major categories were down nearly 10%, with installation and flushing systems down 10.3%, plumbing systems down 9.0% and bathroom systems down 9.9%.

Toto.

April-June Net Profit Down 83%

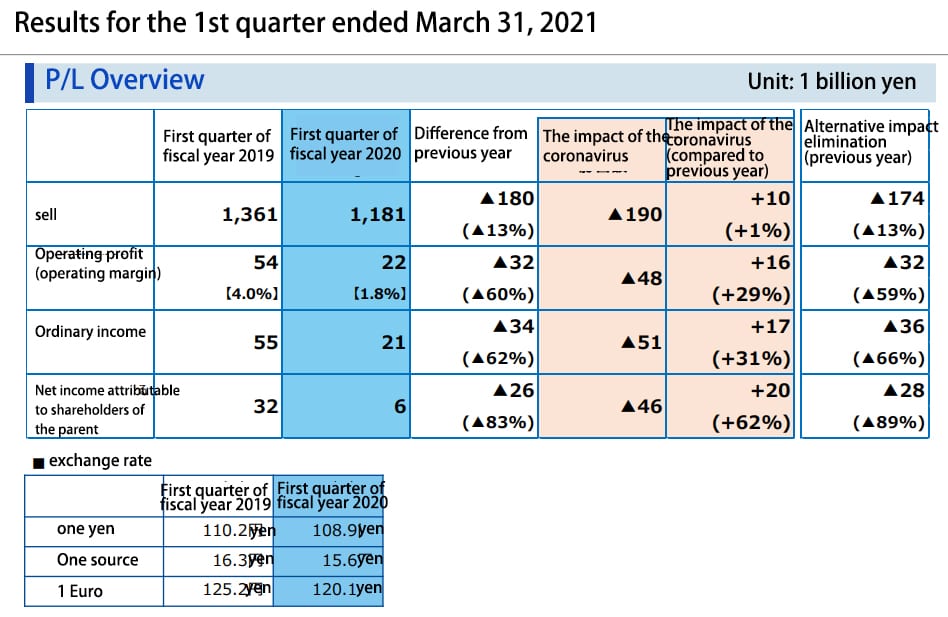

I juli 31, TOTO released its first quarterly report for fiscal year 2020 (april 2020 to March 2021).From April to June 2020, several of TOTO’s financial figures declined year-on-year, including a 13% decrease in sales to 118.1 billion yen (approximately RMB 7,793 miljon), and an 83% decrease in net income attributable to the parent company’s shareholders to 600 million yen (fiscal 2019 TOTO believes that the large decline in sales and net profit is due to the epidemic, and it predicts that without the impact of the epidemic, net profit would have increased by more than 60% in the same period.

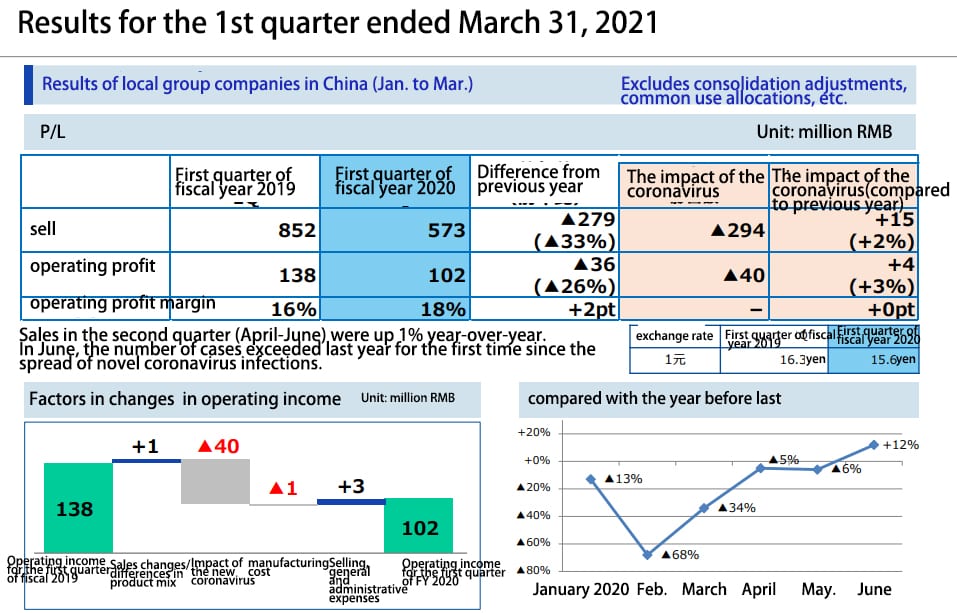

In this earnings report, TOTO lists the January-March operations in China, Asien, Europe and the US separately. In terms of RMB, from January to March, TOTO achieved sales of 573 million yuan in China, ner 279 miljoner yuan, or more than 30%, jämfört med 852 million yuan in the same period last year, TOTO estimated that the epidemic led to a decrease in sales of 294 miljoner yuan. According to TOTO’s statistics, the month with the largest decline in sales in China was February with a 68% decline, followed by a gradual recovery to an increase of 12% in June. In terms of operating profit, the Chinese market also declined by 26% to RMB102 million from RMB138 million in the same period last year.

During the epidemic, TOTO China market sales of all categories have decreased to varying degrees, including a 44% decrease in sanitary ceramics, a 16% decrease in washroom, faucet hardware decreased by 30%, TOTO estimates that if there is no epidemic, sales of the three categories will increase by 1%, 2% och 2%. The financial report also revealed that from January to March, the number of units sold in the Chinese market to wash the beauty of the Chinese market decreased by 28%, and from April to June increased by 6%.

Takara.

Net Profit Down 57.4% In April-June

Den augusti 3, Takara Standard, a Japanese bathroom company, announced its first quarter report for fiscal year 2020 (april 2020 to March 2021).In April-June 2020, Takara Standard achieved sales of 44.092 billion yen (about RMB 2.91 miljard), a year-on-year decrease of 9.0%; the net profit attributable to the parent company fell by 57.4%.

1 [Trends in key management indicators].

|

Set Aside (Pengar) |

146th Meeting

First Quarter (Of Financial Year) Consolidated Cumulative Total |

147th

First Quarter (Of Financial Year) Consolidated Cumulative Total |

146th Issue | |

| Accounting Period | From April 1, 2019

Until 30 juni 2019 |

From April 1, 2020

30 juni 2020 |

From April 1, 2019

Until 31 Mars 2020 |

|

| Sell | (Millions Of Yen) | 48,442 | 44.092 | 201,521 |

| Ordinary Income | (Millions Of Yen) | 3,520 | 1,535 | 13,109 |

| Quarterly Results Attributable To Shareholders Of The Parent Company | (Millions Of Yen) | 2,375 | 1,011 | 8,647 |

| Net Income | (Millions Of Yen) | 2,024 | 2,337 | 7,117 |

| Consolidated Income (Loss) For The Quarter | (Millions Of Yen) | 162,892 | 167,835 | 166,741 |

| Net Assets | (Millions Of Yen) | 252,318 | 251,595 | 256,569 |

| Totala tillgångar | (Yen) | 32,49 | 13.83 | 118.24 |

| Quarterly (Current) Per Share | (Yen) | 一 | 一 | 一 |

| Net Profit | (%) | 64.6 | 66.7 | 65.0 |

| Diluted Earnings Per Share | (Millions Of Yen) | 5,160 | Δ 863 | 17,061 |

| Net Income | (Millions Of Yen) | Δ 1,070 | Δ 1,415 | Δ 5. 021 |

| Capital Adequacy Ratio | (Millions Of Yen) | Δ 1,023 | Δ 1,088 | Δ 2.412 |

| Due To Sales Activities | (Millions Of Yen) | 68,074 | 71,265 | 74,633 |

Net income attributable to shareholders of 1,011 million yen, ner 57.4% år på år. Takara Standard’s forecast for fiscal 2020: sales of ¥188.00 billion, ner 6.7% år på år; net income attributable to shareholders of the parent company of ¥4.100 billion, ner 52.6% year-on-year.Takara Standard said that previously, due to the impact of the epidemic, it is difficult to make a reasonable estimate of full-year results, but With the lifting of the emergency in Japan and the confirmation of fiscal first-quarter results, it is possible to make a reasonable estimate. dock, Takara Standard said that this estimate does not take into account the impact of the second wave of the epidemic and other events, so there are still uncertainties.

It is worth mentioning that Takara Standard announced on July 28 that one of its employees, who works as a construction manager at its Kobe City office, has been diagnosed with neo-coronary pneumonia, and has requested that those in close contact with him be isolated at home and undergo health monitoring. According to another announcement on July 30, an employee working at a showroom in Ebina City, Kanagawa Prefecture, who was identified as a close contact of a patient with neo-coronary pneumonia, was temporarily shut down and the showroom reopened on August 3.

iVIGA Tap Factory Supplier

iVIGA Tap Factory Supplier