Kitchen & Bath Jun Kitchen & Bath Headlines

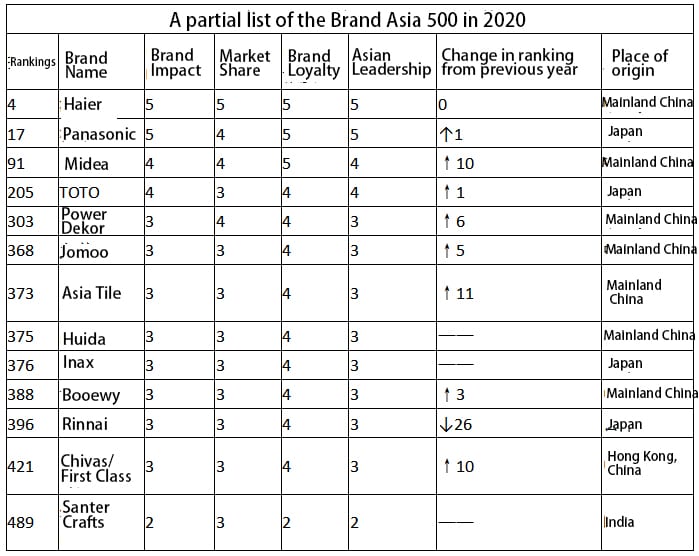

On September 22, the 15th Brand Asia Conference, organized by the World Brand Lab, an organization that assesses the value of globally recognized brands, was held in Shanghai, where the “Top 500 Asian Brands” ranking for 2020 was announced. This year, a number of household or home appliance-related brands are on the list, including Haier, Panasonic, TOTO, Jomoo, Huida, Inax, etc., and the ranking of many companies has improved compared with the previous year.

Sanitary Industry Going Strong.

6 Chinese And Japanese Bathroom Brands On The List

The “Top 500 Asian Brands” list for 2020 is published by the World Brand Lab, one of the world’s top three brand valuation agencies. In terms of regional and industry analysis, brands from 21 countries and regions are included in the “Brand Asia 500”. Among them, China, Japan and Korea have a total of 395 brands on the list, accounting for 79% of the total list, in addition, India and Singapore have 31 and 22 brands selected, respectively, since 2015 included in the assessment of Asia’s top 500 brands in Australia, this year, 13 brands selected. In the home sector, a total of eight Chinese brands, four Japanese brands and one Indian brand made the list. Unlike the previously announced China’s 500 Most Valuable Brands 2020, the ranking of Asia’s Top 500 Brands 2020 is based on four dimensions: brand influence, market share, brand loyalty, and Asian leadership. Among them, Haier scored 5 points in all four dimensions, becoming the “all-around champion”. Compared to 2019, Haier is still firmly in 4th place on the overall list. According to the four dimensions of the list, the brands on the list are all remarkable in the bathroom industry.

(According to the official data compiled by the World Brand Lab, the evaluation of the list is based on the principle of voluntary participation of enterprises, so some brands are not on the list.)

Panasonic Rose 1 Place.

But Market Share Is Down.

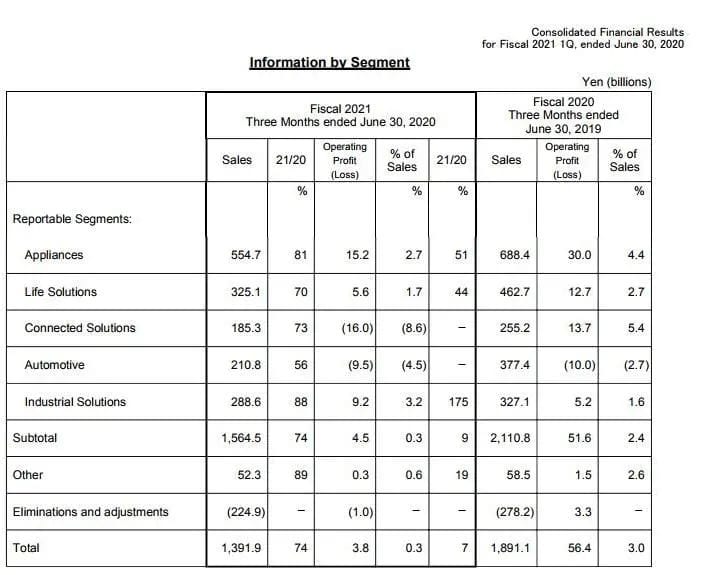

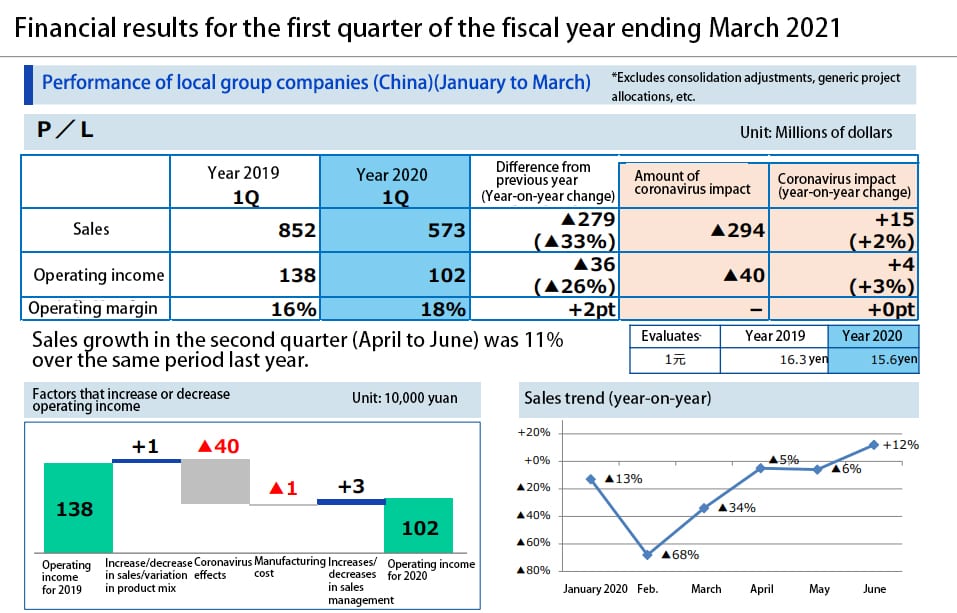

Panasonic ranks 18th in the rankings in 2019 and rises one spot in 2020. However, based on the four dimensions of the index, Panasonic’s market share in 2020 is 4 points, down 1 point from 2019. The related earnings report also proves that Panasonic’s market share declined in 2020. According to Panasonic’s earnings report, total sales for April-June 2020 were ¥139.19 billion, down 26% from the same period last year; total operating profit was ¥3.8 billion, down 93% from the same period last year. In the electrical appliances business, Panasonic’s sales in April-June were 554.7 billion yen, down 19% year-on-year; in the life solutions business, which is part of the bathroom, sales in April-June were 325.1 billion yen, down 30% year-on-year.

According to Panasonic, the severe decline in total sales and operating income in April-June was mainly due to the severe impact of the neo-coronary pneumonia epidemic, as well as business portfolio reform and weak investment demand in China. However, market conditions are now recovering in China and Japan.

Toto Asia Leadership On The Rise.

Declining Brand Loyalty

Compared to 2019, TOTO’s ranking has also risen by one place. In terms of four dimensional indices, in 2019, TOTO’s indices for brand influence, market share, brand loyalty, and Asian leadership were 4, 3, 3, and 5 respectively.In 2020, the indices for these four dimensions were 4, 3, 4, and 4 respectively.In terms of the change in indices, in 2020, TOTO has fallen back in brand loyalty and increased in Asian leadership. According to TOTO’s financial results for the first quarter of fiscal 2020 (April 2020 to June 2020), a number of TOTO’s financial figures declined year-on-year from April to June 2020, including a 13% decrease in sales to 118.1 billion yen and an 83% decrease in net income attributable to the parent company’s shareholders to 600 million yen. By specific market, from April to June 2020, TOTO achieved sales of ¥9 billion, ¥5.9 billion, ¥9.2 billion and ¥1.1 billion in China and Asia, respectively, with sales down 36% and 15% in China and Asia, respectively, while the Americas and Europe grew 17% and 8% against the trend. In terms of operating profit, the Chinese market declined 40%, the Asian market declined 23%, the American market achieved about 3 times the growth, and the European market was flat with the same period last year. The decline in TOTO’s performance in China and Asia is positively correlated with the decline in brand awareness, and the rise in brand leadership in Asia may be beneficial to the recovery of TOTO’s performance in the Asian market. For the overall decline in performance, TOTO believes that the decline in sales and net profit is due to the epidemic, and predicts that without the impact of the epidemic, net profit would have increased by more than 60% in the same period.

Jomoo Up 5 Places On Last Year’s Ranking

Compared to 2019, Jomoo is the bathroom company with the largest increase, up 5 places. Among the four dimensions, in 2019, Jomoo’s indices in brand influence, market share, brand loyalty and Asian leadership are 3, 3, 2, 1. In 2020, Jomoo’s indices in these four dimensions are 3, 3, 4, 3. In terms of market share and brand loyalty, Jomoo has improved by leaps and bounds, and its growth rate ranks first among the major sanitary brands. Jomoo is the most important cornerstone of the brand in recent years. In recent years, Jomoo has taken corporate innovation as the most important cornerstone of the brand’s longevity, deeply integrating technological innovation and digital transformation, and actively benchmarking against the high-end market. From becoming the exclusive supplier of Bird’s Nest and Daxing International Airport, to stationing in China’s cultural landmarks, Summer Palace, the Forbidden City, Potala Palace, and the Great Zhaosi Temple, to leading the bathroom industry to test the private domain flow to create a bathroom live festival, in the previous “World Brand Lab” 2020 “China’s 500 Most Valuable Brands” list. With a brand value of RMB 40.265 billion, Jomoo has been the “top seller” in the domestic sanitary industry for nine consecutive years. The list once again witnessed Jomoo’s strength and growth potential in the Asian sanitary industry.

Huida On The List Again

This year, Huida Sanitary was ranked 375th in the overall list. In terms of brand influence, market share, brand loyalty, and Asian Leadership Index, the performance is good. According to Huida Sanitary 2020 Semi-Annual Report, during the reporting period, Huida Sanitary achieved an operating income of 1.317 billion yuan, a decrease of 11.16% year-on-year; net profit attributable to shareholders of listed companies was 128 million yuan, a decrease of 9.99% year-on-year. The sales revenue of sanitary ceramics was 712 million yuan, accounting for 54%. Among the sanitary ceramics, the sales revenue of smart sanitary ware was 93 million yuan.

During the reporting period, Huida sanitary ware brand invested heavily, including the joint Chinese women’s volleyball shooting brand film, epidemic Chi Chi, selected as a major brand, etc., and became one of the three enterprises visited by Premier Li Keqiang online at the opening ceremony of the 127th Canton Fair cloud. In product design research and development, the reporting period, Huida bathroom new patents authorized 75, including 24 utility model patents, 51 appearance patents.Huida bathroom through the implementation of brand strategy, promote project construction, increase investment in research and development, optimization of internal management, etc., continued to steadily improve its brand influence, market share, brand loyalty, Asian leadership.

This is the fifteenth time that World Brand Lab has measured the influence of Asian brands, and 500 brands from 21 countries and regions have been selected. With rising labor costs and an aging workforce in China and East Asia, Asian brands are focusing on high-end industries and internationalization,” said Professor Robert Mundell, Chairman of the World Brand Lab. In addition, Asia’s middle class is no longer satisfied with luxury goods; they want clean air, safe food and more leisure, and are passionate about social networking and online shopping, making it imperative for Asian brands to develop new ways of communicating. Asian brands will need to undergo a series of fundamental shifts to unlock their huge market potential, and brand management must be based on a sharper observation of consumer behaviour patterns”.

Although the list is only indicative and not absolutely authoritative, and many of the best brands from various industries such as home, tile and bathroom are not included in the list, the brands on the list, whether it is home, tile or bathroom, are increasing in brand value, which also shows that after years of development, the monetary value of Chinese brands is increasing.

iVIGA Tap Factory Supplier

iVIGA Tap Factory Supplier