Kitchen And Bathroom Industry Mainstream Media Kitchen And Bathroom News

After four months of declines, sales of U.S. manufactured homes increased for the second consecutive month in July as housing inventories continued to improve, according to the National Association of Realtors (NAR). In July, total sales of existing homes, including single-family homes, townhouses, condominiums and co-ops, rose 2.0 feem pua. The seasonally adjusted annual rate was 5.99 million units. Compared to the same period last year, sales were up 1.5 percent from a year ago.

tiam sis, higher construction costs and a shortage of supply and rising home prices pushed builder confidence to its lowest level since July 2020, according to the Housing Market Index (HMI) released by NAHB. In August, builder confidence in the new single-family housing market fell to 75, said NAHB Chairman Chuck Fowke, “Buyer traffic has fallen to its lowest level since July 2020 as some potential buyers are experiencing price shocks due to rising construction costs. Policymakers need to find solutions to long-term supply chain problems.”

According to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau, supply chain and labor shortages have led to a 7.0 percent decline in overall housing starts. The seasonally adjusted annual rate is 1.53 million units. If this situation continues in the coming months, it will affect the consumption of bathroom goods.

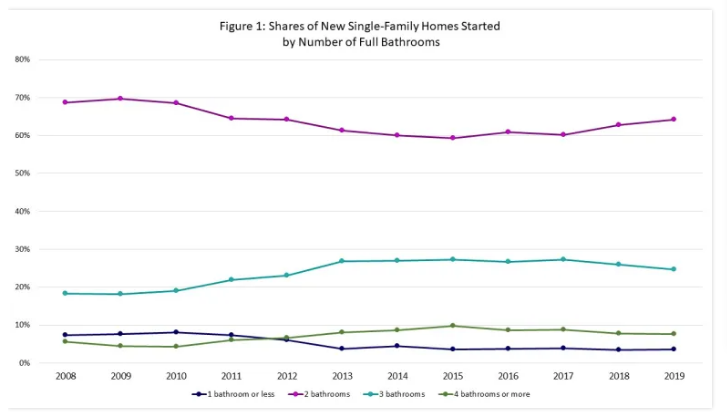

Prior to the outbreak, the U.S. Census Bureau’s Survey of Construction (SOC) showed a change in the number and share of bathrooms and half-bathrooms in new single-family homes started in the U.S. hauv 2019. Raws li cov ntaub ntawv, 4 percent of new single-family home starts had one bathroom or less. 64 percent of new single-family homes had 2 bathrooms, 25 percent of new single-family homes had 3 bathrooms, Thiab 8 percent of new single-family homes had 4 bathrooms or more.

The survey shows that the percentage of new single-family homes with less than 1 or more than 2 bathrooms increased compared to 2018, but the percentage of new single-family homes with 3 Lossis 4 bathrooms or more onwards decreased. Tsis tas li ntawd, the share of new homes with 2 bathrooms consistently outpaced other per-unit bathroom categories. The share of single-family homes with 3 or more bathrooms has generally declined. This is associated with an increase in median sales and contract prices per square foot. As construction costs increase, builders are finding it more prudent to install new single-family homes with fewer bathrooms.

Raws li cov ntaub ntawv, a greater percentage of single-family homes in the higher end of the scale have three or four bathrooms or more. Conversely, there are fewer bathrooms in single-family homes in the lower tiers. nyob rau hauv 2019, 62 percent of new single-family homes less than 1,200 square feet have one or fewer bathrooms. In the next tier of single-family homes, 90% of new homes between 1,200 Thiab 1,599 square feet in size have 2 bathrooms. Thaum kawg, move to the highest tier of home size, which is the size of homes with more than 5 bathrooms. 2019 SOC data shows variation in the number of bathrooms by census sector. New homes with 3 or more bathrooms started in 2019 accounted for 32 percent of all new single-family homes started, down from 34 percent in 2018.

yav tas los, NAHB had made an optimistic estimate of consumer spending on bathroom goods in the U.S., which is expected to reach $89 tsheej lab 2021, said Danushka Nanayakkara-Skillington, assistant vice president of forecasting and analysis at NAHB: “Builders are slowing construction activity as costs rise. Construction started on a good footing this year, but in recent months, some projects have been forced to pause due to material availability and costs.”

Continued supply chain disruptions are having a serious impact on material prices causing product backlogs and freight costs causing delays in kitchen and bathroom project schedules. Most construction market experts predict that the current challenges affecting the kitchen and bath product supply chain are temporary rather than permanent and should mostly dissipate over the next year.

Data from the National Association of Home Builders show that material shortages are now more prevalent than at any time since the 1990s, and rising costs coupled with these shortages have reduced builders’ confidence in the market to the lowest level in a year.

iVIGA Tap Factory Supplier Supplier

iVIGA Tap Factory Supplier Supplier