Original Kitchen & Bathroom News Kitchen & Bathroom Headlines

On August 12, local time, Asian Granito India Limited (hereinafter referred to as “AGL”), one of India’s four major ceramic sanitary ware companies, announced its report for the first fiscal quarter ended June 30, 2022 (2022.4-6). Sales for the period were Rs. 3.100 billion (approximately Rs. 264 million), an increase of approximately 12% year-over-year. Combined with AGL’s previously announced January-March sales data, the company achieved total sales of Rs. 7.887 billion (approximately RMB 670 million) in the first half of 2022.

First-half sales of approximately $670 million.

Revenue increase without profit increase

According to AGL’s first-quarter report, the company achieved sales of Rs 3.100 billion in the April-June period of 2022. This is higher than the Rs. 2.729 billion in the same period of the previous year, an increase of about 12 percent. In combination with the previously announced figures, AGL reported sales of Rs. 7.887 billion (approximately Rs. 670 million) in the first half of 2022. Despite the increase in sales, net profit for the April-June period was a loss of Rs. 20.97 million, compared to a profit of Rs. 82.18 million in the same period of the previous year. Basic loss per share for the same period was Rs. 0.23, compared to basic earnings per share from continuing operations of Rs. 2.4 a year ago.

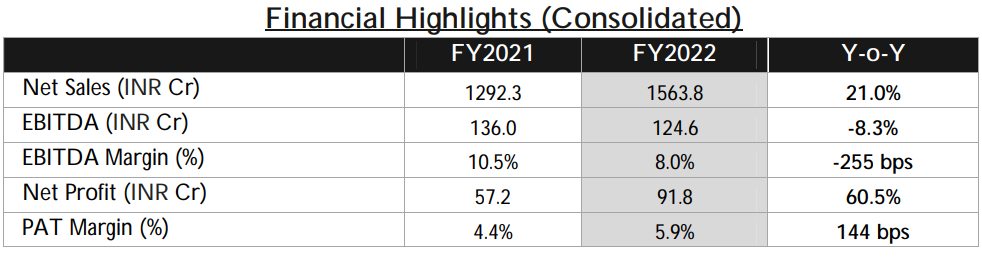

Also according to AGL’s annual report for fiscal year 2021 (2021.4-2022.3), which was released in May this year. The company achieved sales of Rs. 15.638 billion (approximately Rs. 1.329 billion) in FY 2021, up 21% from Rs. 12.923 billion in FY 2020. This is a record high. Despite the positive sales, there was a decline in profits. EBITDA (earnings before taxes, interest, depreciation and amortization) for the full fiscal year was Rs125 million, down 8.3% year-on-year. Profit margin also slipped to 8.01% from 10.5%.

Kamlesh Patel, chairman of AGL, said the company achieved its best-ever results in fiscal 2021 despite the pressure on the ceramics industry in terms of gas prices, raw material prices, coal prices and international freight rates. He said AGL’s strategy going forward is to continue to improve margins and expand its brand presence in the high-end flooring and bathroom industry.

Founded only 22 years ago, the main business includes sanitary ware, tiles and flooring, etc.

Public information shows that AGL was established in 2000 in Ahmedabad, the main commercial city of Gujarat, India. After more than 20 years of development, AGL has now become one of the most influential ceramic sanitary ware companies in India. At present, AGL has 9 production sites and about 300 showrooms in Gujarat, and 12 showrooms across India. Its products are not only sold in India, but also exported to more than 100 countries and regions around the world.

AGL’s main products include tiles, engineered marble, quartz, sanitaryware and plumbing hardware, and its businesses are carried out in the form of subsidiaries. The subsidiaries are responsible for the tile, sanitaryware and flooring businesses. Among them, the bathroom subsidiary AGL Sanitaryware Pvt Ltd not only produces its own bathroom products. They also sell products from third-party manufacturers in India as well as from foreign companies under the AGL brand through OEMs.

Tile and flooring are also AGL’s main business, especially in the tile business. AGL’s production capacity has increased from 800,000 square meters per year in 2000 to 34.5 million square meters at present, making AGL one of the most influential local tile brands in India. In addition, AGL Surfaces Pvt Ltd, which is responsible for the flooring business, is well known for its stone crystal flooring (a new variety of PVC flooring) products. In recent years, they have focused on expanding their product portfolio and strengthening their export business as their development objectives.

The Indian market continues to expand with

AGL buys land for $425 million to build a factory

India is the second largest consumer country in the world, with huge potential in the consumer market. At the same time, in recent years, India is also actively carrying out the “Clean India” campaign, local residents’ health and hygiene awareness has increased, and the demand for sanitary products continues to increase. In such a context, Indian building materials companies actively expand production capacity to adapt to their own development and meet market demand.

Around capacity expansion, AGL announced in May this year that it had acquired a piece of land in Gujarat’s Morbi region and spent 5 billion rupees (about RMB 425 million) to establish three new production bases. Among them, the new bathroom factory covers an area of 45,122 square meters, with an annual capacity of about 660,000 pieces. The ceramics plant and the flooring plant occupy 69,506 square meters and 18,715 square meters respectively. After the commissioning, the production capacity of the company’s three major categories will be expanded. In addition, AGL also plans to build the largest new showroom in India on the site. AGL expects that this expansion and the new showroom plan will add Rs. 10 billion to Rs. 12 billion to the company’s annual sales, equivalent to double.

In addition to AGL, other local Indian sanitary ware companies such as Cera Sanitaryware and Kajaria Ceramics have also accelerated the pace of production capacity layout. And global companies such as Roca and Lixil are also actively expanding production, seeking to continue to dominate the Indian bathroom market. For example, Roca’s Indian subsidiary in 2019 announced an investment of about 500 to 700 million yuan in India faucet factory and sanitary plastic (toilet seat, etc.) factory.

Lixil, although it only set up its subsidiary Lixil India Sanitarywares Pvt in India in 2018, has set a development target of capturing 15%-20% of the Indian market in three years. In addition, Chinese companies have also actively laid out the Indian market in recent years.

Haiou Housing, R&T, Luda International and other companies have branches in India, in addition to a large number of domestic companies operating in India.

It can be seen, for AGL, the company’s sales data hit a record high, but the Indian bathroom market in the gradual “Red Sea” to stand out. This difficulty can not be described as not too big.