Original Kitchen And Bathroom Jun Kitchen And Bathroom Headlines

In the first half of the year, by the impact of real estate, epidemic and other aspects, many sanitary ware companies are caught in a slowdown in growth. Although the industry as a whole downward trend, but the performance of some products such as intelligent sanitary ware is still bright. According to a number of listed sanitary ware enterprises public semi-annual report, many companies to achieve revenue growth in the intelligent sanitary ware business, including two companies grew by more than 20%. Even if there are companies related to business revenue decline, the magnitude is not obvious. Throughout the global market, the intelligent sanitary industry still has a broad space for growth.

Two companies smart toilet revenue growth of more than 20%

In the evening of August 29, Megmeet announced its semi-annual report for 2022. In January-June, Megmeet achieved revenue of 2.705 અબજ યુઆન, નો વધારો 39.59% વર્ષ-દર-વર્ષ. Net profit attributable to shareholders of listed companies was NT$224 million, નો વધારો 14.97% વર્ષ-દર-વર્ષ.

Megmeet is an industry giant in the field of power electronics, with revenue from related products accounting for 90.72% of total revenue for the same period. The remaining 9.28% was contributed by the smart bathroom business, with related products revenue of 251 મિલિયન યુઆન, નો વધારો 21.96% વર્ષ-દર-વર્ષ. નફાના સંદર્ભમાં, the intelligent bathroom business also performed well. Semi-annual report also shows that Megmeet first half intelligent bathroom business gross margin reached 25.01%, higher than the power electronics.

Unit: Yuan

| Operating income | Operating Costs | Gross margin | Operating income increased or decreased compared with the same period of the previous year | Increase or decrease in operating costs compared with the same period of the previous year | Gross profit margin Increase or decrease over the same period of last year | |

| Sub-Industry | ||||||

| Smart Bathroom | 251,142,400.65 | 18&343,788.83 | 25.01% | 21.96% | 23.26% | -0.79% |

| Power Electronics | 2.453.684,473.65 | 1,882,842,111.90 | 23.26% | 41.68% | 49.12% | -3.83% |

| Sub-products | ||||||

| Intelligent home appliance electric control products | 1,433,552,147.55 | 1,118,552,291.95 | 21.97% | 36.88% | 38.17% | -0.73% |

| Industrial power supply | 561,444,048.78 | 416,775,975.26 | 25.77% | 43.24% | 52.24% | -4.39% |

| Industrial Automation Products | 451,905,949.49 | 323,979,416.92 | 28.31% | 11.63% | 22.21% | -6.20% |

| New Energy and Rail Transit | 249,804,393.63 | 207,380,913.33 | 16.98% | 185.64% | 216.92% | -8.20% |

| Other Businesses | 8,120,334.85 | 4,497,303.27 | 44.62% | 30.94% | 190.84% | -30.45% |

| By Region | ||||||

| Domestic Sales | 1,753,426,155.37 | 1,353,140,90&46 | 22.83% | 23.25% | 31.64% | -4.92% |

| Foreign Sales | 951,400,718.93 | 718,044,992.27 | 24.53% | 84.72% | 85.32% | -0.24% |

In the event that the statistical caliber of the company’s main business data is adjusted in the reporting period, the company’s main business data for the most recent 1 period as adjusted by the caliber at the end of the reporting period.

Megmeet first half intelligent bathroom revenue reached 251 મિલિયન યુઆન

It is reported that Megmeet’s intelligent bathroom business is mainly carried out by a wholly-owned subsidiary Zhejiang Ikahe Sanitary Ware Co. Megmeet said in its financial report that the company’s intelligent sanitary ware is in steady development. As a mainstream domestic ODM manufacturer of intelligent sanitary ware, the company has increasingly extensive customer coverage in domestic and international brand owners and e-commerce, which can support sustainable development in the future.

Ikahe bathroom intelligent toilet products

In addition to Megmeet, આર&T’s smart bathroom business revenue also increased by more than twenty percent. According to R&ટી

The semi-annual report shows that the company’s first half of the intelligent toilet and cover business revenue of about 411 મિલિયન યુઆન, નો વધારો 21.65% વર્ષ-દર-વર્ષ, accounting for 45.64% of total revenue. The half-yearly report also shows that R & T’s responsible for the research and development, production and sales of intelligent sanitary products Xiamen a little intelligent technology limited company, the first half of revenue also reached 274 મિલિયન યુઆન. In the first half of the year, આર&T’s domestic and overseas revenue accounted for 66.17% અને 33.83%, અનુક્રમે. This is not a bad result compared to some of the domestic market-oriented companies. r & t first half of intelligent toilet and cover revenue of about 411 મિલિયન યુઆન

Unit: Yuan

| Current reporting period | Same period of previous year | Year-on-year increase/decrease | |||

| Amount | Share of operating revenue | Amount | Share of operating revenue | ||

| Total Operating Income | 900, 63& 099. 96 | 100% | 803, 319, 911.67 | 100% | 12. 11% |

| By Industry | |||||

| Industry | 900, 63& 099. 96 | 100. 00% | 803, 319, 911.67 | 100. 00% | 12. 11% |

| By Product | |||||

| Water tanks and accessories | 36& 380, 403. 93 | 40. 90% | 36& 634, 489. 89 | 45. 89% | -0. 07% |

| Smart Toilet and Cover Plates | 411,057, 941.79 | 45.64% | 337, 905, 473. 07 | 42. 06% | 21. 65% |

| Co-Level Drainage Products | 79, 943, 507. 07 | 8.88% | 66,868,105. 72 | 8. 32% | 19. 55% |

| Others | 38, 598,013. 40 | 4. 29% | 2& 124,409. 35 | 3. 50% | 37. 24% |

આર&T’s revenue for smart toilets and covers in the first half of the year was about 411 મિલિયન યુઆન

Part of the enterprise decline or growth slowdown trend

Although some companies increased revenue from intelligent toilets, but there are still many companies in the same kind of business revenue declined or growth slowed down year-on-year.

From the domestic side, Huida Sanitary Ware has a holding subsidiary mainly engaged in the production and marketing of smart home, Huimei technology, operating income of 0.32 billion yuan in the first half of the year, down from 0.35 billion yuan in the same period in 2021. Hanyu Group’s subsidiary has responsible for the health toilet and intelligent toilet business of Dier Gut Health Technology Co. The revenue for the first half of the year was 0.51 અબજ યુઆન, also lower than the 0.57 billion yuan for the same period in 2021.

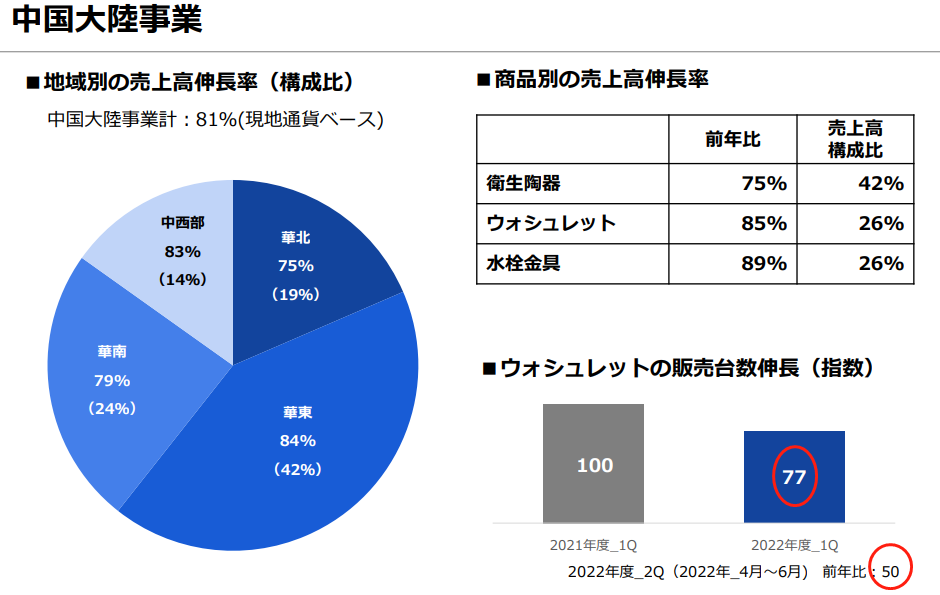

From the foreign side, in the case of TOTO, ઉદાહરણ તરીકે, the financial report showed that the company’s sales of smart toilets in the first and second quarters in mainland China decreased by 23% અને 50%, અનુક્રમે. And sales in the global market is also said to be less than ideal, ઉદાહરણ તરીકે, in the Americas. Their sales of smart toilets increased by 18% in the first quarter, but fell back by 8% in the second quarter. In Europe, sales increased by 32% in the first quarter. But the second quarter saw only an 11% increase, a significant slowdown in growth.

TOTO first and second quarter sales of intelligent toilets in mainland China decreased by 23% અને 50%, અનુક્રમે

The bathroom company’s intelligent toilet products in some markets such as China’s revenue decline. This is obviously affected by a number of aspects. The rebound of the epidemic and the downturn in the real estate industry are the main reasons. While in foreign markets, it saw a significant decline in 2020 as the epidemic outbreak emerged. માં 2021, after the normalization of the epidemic, it turned to a big increase in sales. After a big ups and downs, it entered 2022, while its turnover leveled off.

The global intelligent sanitary industry still has a vast space for growth

Regardless of the companies’ smart toilet revenue increase or decrease, the global major markets for smart toilet demand continues to rise is a fact. Especially in the context of the normalization of the epidemic, people’s demand for home health continues to increase. The presence of smart toilets in home life has also increased significantly.

According to Aowei Cloud, માં 2021, the number of smart toilet supporting projects in China’s finishing market is 843, ઉપર 39.8% વર્ષ-દર-વર્ષ. Refurbishment market smart toilet supporting the size of 728,000 units, નો વધારો 35.8% વર્ષ-દર-વર્ષ, the configuration rate rose to 25.4% વર્ષ-દર-વર્ષ. જોકે, compared to Japan and South Korea and other countries, the current domestic smart toilet penetration rate is still low. There is still a huge space for future popularity.

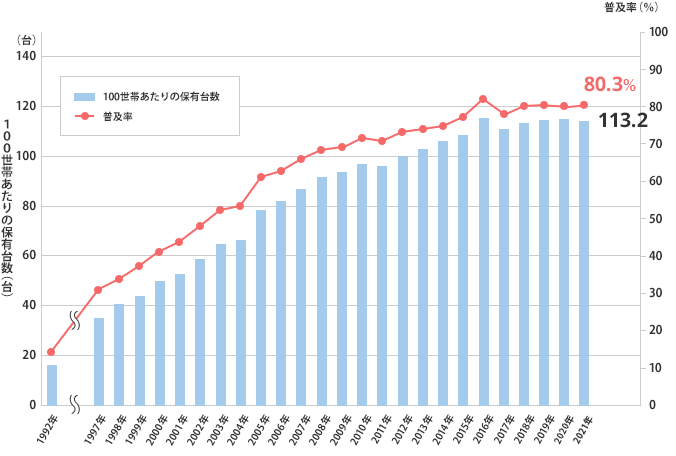

In Japan, the birthplace of the intelligent toilet, according to the local bathroom industry association statistics, as of the end of June 2022, the intelligent toilet shipments have exceeded 100 million units. And the Japanese market smart toilet supply and demand stability, ત્યારથી 2013 the annual shipments are more than 4 million units. The current penetration rate has reached 80.3%. જોકે, with the emergence of energy-saving, water-saving products, the Japanese smart toilet industry is expected to appear a wave of new wave.

Japan’s intelligent toilet penetration rate reached 80.3%

In Europe, according to the German research institute TIZE, the top 10 countries in Europe (જર્મની, Austria, Switzerland, the Netherlands, Belgium, the United Kingdom, ફ્રાન્સ, ઇટાલી, Spain and Poland) sold 100,000 smart toilets in 2021. તેમની વચ્ચે, the share of smart toilet all-in-one reached 70.8%. Universal smart toilet accessories accounted for 19.8% . Concealed smart toilet accounted for 5.3%, concealed smart toilet accessories accounted for 4.1%. It cannot be denied that the European smart toilet penetration rate is also not high, the development space is equally broad.

iVIGA ટેપ ફેક્ટરી સપ્લાયર

iVIGA ટેપ ફેક્ટરી સપ્લાયર