Gnìomhachas Cidsin Agus Seòmar-ionnlaid Meadhanan Prìomh Shruth Fiosrachadh Cidsin Agus Seòmar-ionnlaid

According to the Kitchen Cabinet Manufacturers Association of America (KCMA) website, on November 3, 2022, na SA. Department of Commerce notified Schagrin Associates of the final results of the first administrative review of the anti-dumping and countervailing case against wooden cabinets, bathroom cabinets and their components from China.

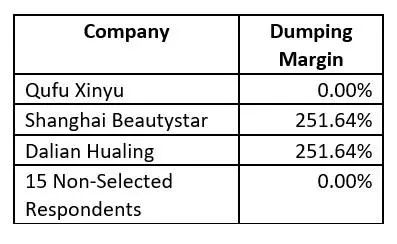

The first review period is from October 2019 gu Màrt 2021. The U.S. Department of Commerce said there is no change from the preliminary results. According to the calculation, the dumping margin of mandatory respondent Qufu Xinyu ( Qufu Xinyu ) tha 0. The dumping margin of mandatory respondent Shanghai Qifu ( Shanghai Beautystar ) tha 251.64%. Voluntary respondent Dalian Hualing (Dalian Hualing) has a dumping margin of 251.64%. A bharrachd air, an 15 unselected respondent companies under review have a dumping margin of 0.

KCMA clearly states in the article that it will also significantly increase the anti-dumping duty rates of the 16 Chinese companies that now have zero duty rates.

An-dràsta, Chinese companies exporting cabinets, etc. are still subject to the anti-dumping duty order. The current countervailing duty rate for companies not under review is 20.93%. Taking into account the 25% 301 tariff, a total of 45.93% of the total tariff is still payable.

iVIGA Tap Factory Supplier

iVIGA Tap Factory Supplier