Industria di cucina è bagnu originale Mainstream Media Informazioni di cucina è bagnu

U ghjugnu 28, 2021, the official website of the Securities and Futures Commission released the pre-disclosure prospectus (filing draft) of Hangzhou Panasia Sanitary Ware Co. Hangzhou Panasia Sanitary Ware Co., Ltd. intends to be listed on the main board of Shenzhen City. It made an initial public offering of approximately 31,266,700 shares, cuntabilità per 25% of the total number of shares of the company after the issuance. The underwriter of the public offering of shares is Guoxin Securities Co.

Release Overview

| Type of shares issued | Ordinary shares in Renminbi (A K) |

| Number of shares issued | 31,266,667,000 shares, representing 25.00% of the total number of shares of the Company after the issue |

| Par value per share | 1.00 Yuan |

| Issue price per share | 【】Yuan |

| Expected Issue Date | 【】Year 【】Month 【】Day |

| Stock exchange to be listed | Shenzhen Stock Exchange |

| Total share capital after the issue | 12,506.6667 million shares |

| Restrictions on the circulation of shares held by shareholders before the issue and commitment to voluntarily lock up shares | The controlling shareholder, R&S Holdings, the shareholder, Pan Asia Juxian, the effective controllers, Zhang Boliang, Ye Rujun, Zhang Ye, Yao Lei, the director, senior management, Jiang Yurong, senior management, Chu Zhongliang, senior management, Mao Lianjuan, senior management, Fang Jianwei, supervisor, Jiang Yanqun, supervisor, He Zhuanwei, undertake not to transfer or entrust others to manage the shares of the issuer held directly or indirectly by me/the partnership prior to the initial public offering of the shares of the issuer, nor to have such shares repurchased by the issuer, for a period of 36 months from the date of listing of the shares of the issuer.

Shareholders Shangxian Trade, Guangfeng Investment and Tongjin Investment undertake not to transfer or entrust others to manage the shares of the issuer issued prior to the initial public offering of shares held directly or indirectly by the partnership of the Company for a period of 12 months from the date of listing of the shares of the issuer, and not to have such shares repurchased by the issuer. The controlling shareholder, R&S Holdings, the shareholder, Pan Asia Juxian, the actual controller, the directors and senior management holding shares of the Company undertake that the price at which I/the Company/the Partnership shall reduce the shares of the Company within two years after the expiry of the above lock-up period shall not be lower than the issue price. If the closing price of the Company’s shares is lower than the issue price for 20 consecutive trading days within 6 months after the listing of the Company (if the issuer’s shares are distributed as dividends, bonus shares, capitalization of capital reserves, ecc. during this period, the issue price shall be adjusted accordingly, the same below), or if the closing price is lower than the issue price at the end of 6 months after the listing (if the day is not a trading day, the first trading day after the day), I/the Company/the Partnership shall The Company/ |

According to the prospectus, the funds raised are used for the project and the number of funds to be invested in the fund-raising: the construction project of the intelligent manufacturing production base for kitchen and bathroom products is to be invested to raise about 357 millioni di yuan. The kitchen and bathroom R & D center and the construction project of information technology will be invested to raise funds of about 105 millioni di yuan. The project of intelligent manufacturing and expansion of sanitary products is to invest about 106 millioni di yuan. The shares, after the issue, are intended to be listed on the main board of the Shenzhen Stock Exchange.

Before this issue, R&S Holdings holds 56.29% of the shares owned by the issuer, and is the controlling shareholder of the issuer. The actual controllers are Zhang Boliang, Ye Rujun, Zhang Ye and Yao Lei. Zhang Boliang and Ye Rujun are husband and wife. Zhang Ye is the son of Zhang Boliang and Ye Rujun. Yao Lei is the spouse of Zhang Ye.

The annual revenue of the enterprise is 1.1 miliardi di yuan, and the row of rods to achieve the first in the world.

According to Panasia, its main business is the research and development, production, and sales of kitchen and bathroom household products. Its main products include bathroom accessories such as rows of rods, rubinetti, elbows and hoses, as well as kitchen cabinets, bathroom cabinets, and other kitchen and bathroom furniture products.

According to the kitchen and bathroom information, Panasia’s advantageous products are hardware and cabinet products, and its rows of rods are the first in the world, as well as the invisible champion in the hardware segment.

According to the prospectus, in the reporting period, its operating revenue in 2020, 2019 è 2018 were 1.1 miliardi, 808 million and 740 million respectively. The net profit attributable to shareholders of the parent company is 118 millioni di yuan, 66.42 million yuan and 20.17 millioni di yuan, respectively. À mezu à elli, the amount of foreign sales revenue was 380,690,500 Yuan, 443,219,000 Yuan and 73,252,700 Yuan respectively, cuntabilità per 52.52%, 55.43%, è 67.26% of the main business revenue respectively.

(-) Key figures in the consolidated income statement

Unit: millioni di yuan

| Projects | Year 2020 | Year 2019 | Year 2018 |

| Operating income | 110,202.74 | 80,884.06 | 74,325.88 |

| Operating profit | 12,694.86 | 8,470.94 | 3,581.37 |

| Total profit | 13,159.04 | 8,392.37 | 3,298.47 |

| Net profit | 12,28346 | 7511.61 | 2,409.32 |

| Net profit attributable to shareholders of the parent company | 11,793.29 | 6,64267 | 2,017.48 |

| Net profit after non-recurring gains and losses attributable to shareholders of the parent company | 8,772.55 | 6,237.98 | 4,706.74 |

It is reported that Panasia has a total of 9 wholly-owned subsidiaries and 2 branches. They have secured export business to the U.S. by laying out kitchen and bathroom furniture production bases in Vietnam and Thailand in advance. Hangzhou Huijia Kitchen & Bath, a subsidiary of Panasia Group, invested USD 8 million to set up a wholly-owned subsidiary Huijia (Vietnam) Cucina & Bath International Limited Liability Company in Thuan Dao Industrial Development Zone, Long An Province, Vietnam. It opened on June 18, 2019. the opening ceremony was attended by Panasia’s major customer, BGI Group. The prospectus shows that the company is now in a stable operation stage and is the main body of its kitchen and bathroom furniture production and sales. In FY2019 and FY2020, Vietnam Huijia achieved operating revenue of RMB158,047,200 and RMB467,716,000, respectively. As of the end of the reporting period, the book value of fixed assets was RMB26,670,000.

Opening of Huijia (Vietnam) Cucina & Bath International Co.

And Panasia, located in Rayong, Tailanda, was established in December 2020, according to the prospectus. It mainly produces kitchen cabinets and is currently in the pilot production stage.

Panasia’s exports to the U.S. account for 2.22% of the U.S. share of kitchen cabinets imported from China and Vietnam.

The prospectus shows that during the reporting period, Panasia’s sales revenue to its top five customers were RMB573,667,600, RMB620,107,700 and RMB870,561,000, cuntabilità per 77.17%, 76.65% è 79.68% of the operating revenue for the period, respectively, with a high degree of customer concentration.

Major customers include Kohler (Kohler), Moen (Moen), Delta (Delta), Hansgrohe (Hansgrohe), Grohe (Grohe), Standard americanu (Standard americanu), TOTU (TOTU), Roca (Roca), ecc., including cooperation with Kohler (Kohler), Moen (Moen), Delta (Delta), Standard americanu (Standard americanu) and other brands for more than 15 anni.

The prospectus shows that in FY2019, Panasia Kitchen Cabinets’ exports to the U.S. accounted for approximately 2.22% of the market share of U.S. kitchen cabinet imports from China and Vietnam (according to the United Nations Commodity Trade Database).

Da 2011-2019, U.S. sales of kitchen cabinet products imported from abroad increased significantly from approximately $609 million to $1.713 miliardi, representing a compound annual growth rate of approximately 13%. In listessu tempu, the market share of foreign imports also expanded from 4.59% in 2011 à 9.57% in 2019, of which, China is the number one source of kitchen cabinet products imported from the United States.

À mezu à elli, RTA kitchen cabinets, as one of the RTA furniture segments, continue to grow in the U.S. kitchen cabinet market with the advantages of cheap price, good quality and easy assembly. According to the survey report released by the U.S. International Trade Commission (U.S. International Trade Commission), RTA kitchen cabinets are the most significant component of U.S. imports of kitchen cabinets and bathroom cabinet products from China. In FY 2016-2018, the import quantity of RTA kitchen cabinets accounted for 68.6%, 69.9%, è 69.8% of the total imports of kitchen cabinets and bathroom cabinets from China, respectively. In FY2016-2018, the value of U.S. imports of RTA kitchen cabinets from China increased by 43.8%.

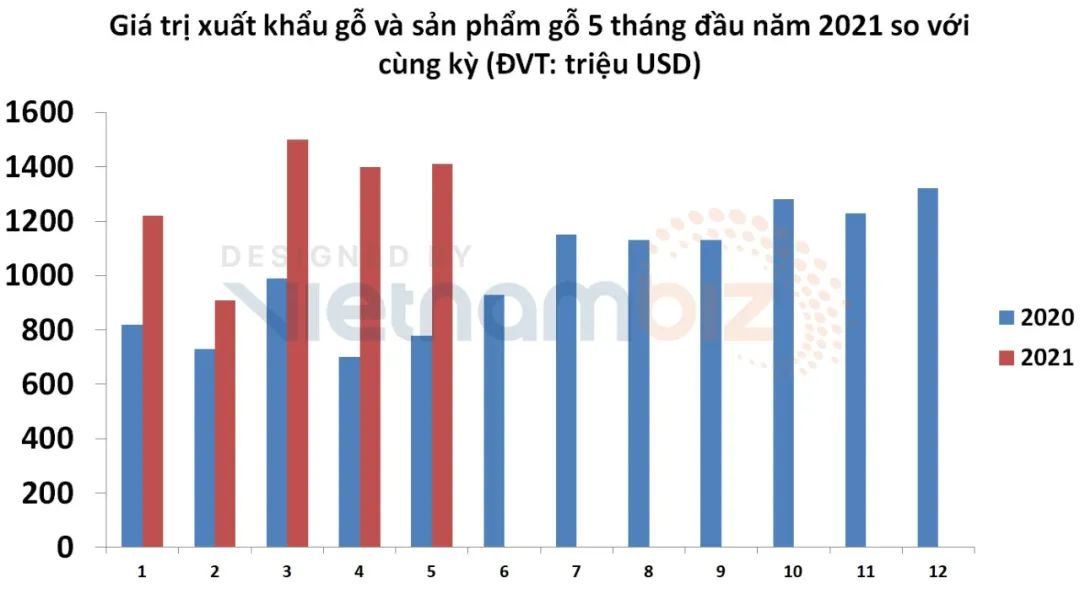

Affected by the trade friction between China and the U.S. and the anti-dumping duties and countervailing duties imposed by the U.S. on kitchen and bathroom cabinet products from China, the U.S. kitchen cabinet importing countries show a trend of shifting from China to Vietnam. In FY2019 and FY2020, the total amount of U.S. furniture imports from China decreased by 28% è 25%, respectively, compared with the same period of the previous year. Total U.S. furniture imports from Vietnam increased by 35% è 31%, respectively, compared with the same period of the previous year. In 2020, Vietnam overtook China to become the top furniture importer in the United States. According to the General Administration of Vietnam Customs, in May, Vietnam’s exports of wood and wood products exceeded US$1.41 billion, a slight increase of 1.2% compared to April, but an increase of more than 82% compared to May 2020.

Vietnam Customs Administration: Exports of wood products in the first five months of 2021 compared to the first five months of 2020

In 2019 è 2020, China’s exports of wood furniture for kitchens to the US amounted to $5.730 billion and $1.301 billion respectively, giù 40% è 77% compared to the same period of the previous year. Vietnam’s exports of U.S. wood furniture for kitchens in 2019 ammontava à $1.547 miliardi, su 61% da 2018. The U.S. kitchen cabinet importers show a trend of shifting from China to Vietnam.

In March 2021, the U.S. Department of Commerce asked more than 60 Vietnamese plywood companies to explain many issues related to the country’s plywood exports. Companies producing kitchen cabinets, bathroom cabinets and furniture in Vietnam may also face the risk of high anti-dumping duties in the U.S. market. (For related links, click to read: Vietnam proposes to review bathroom cabinet import companies in Vietnam)

It is worth noting that BGI Group (U.S. Cabinet Depot), one of Panasia’s major purchasers of RTA kitchen cabinets for export to the U.S., is being investigated by U.S. Customs and Border Protection. According to the public information on the relevant U.S. situ web, U.S. Customs and Border Protection believes that BGI Group has circumvented the regulations in the anti-dumping tariff and countervailing tariff investigations by trans-shipping wooden kitchen cabinets and bathroom cabinets originating from China through Cambodia and not declaring the goods as applicable orders, respectively. The U.S. Customs and Border Protection conducted relevant investigations against BGI Group in relation to the above matters.

During the reporting period, Panasia’s operating revenue to BGI Group amounted to RMB123,610,900, RMB164,068,000 and RMB398,790,800 respectively, cuntabilità per 16.63%, 20.28% è 36.19% of the Company’s operating revenue respectively. As of the end of the reporting period, the Company’s accounts receivable balance from BGI Group was RMB72,934,500, cuntabilità per 24.29% of the Company’s accounts receivable balance.

Panasia indicated that, as a supplier of BGI Group, it is not a party to the aforementioned investigation matters. The aforementioned investigation matters do not involve the products sold by the Company to BGI Group. The Company’s business with the BGI Group is also not physically affected. As of the end of 2020, the BGI Group was in good operating and financial condition. Tuttavia, if the BGI Group is subject to punitive measures such as paying back duties or incurring fines as a result of the aforementioned investigation matters, the BGI Group’s operations and financial condition may be negatively affected. This will in turn affect the business cooperation with the Issuer or affect the recovery of the Issuer’s accounts receivable and adversely affect the production and operation of the Issuer.

Fornitore di iVIGA Tap Factory

Fornitore di iVIGA Tap Factory